USD/MXN rises above 20.50 as markets tumble, eyes 20.70

- Emerging market currencies are under pressure amid risk aversion.

- Mexican peso heads for the lowest daily close since March versus the US dollar.

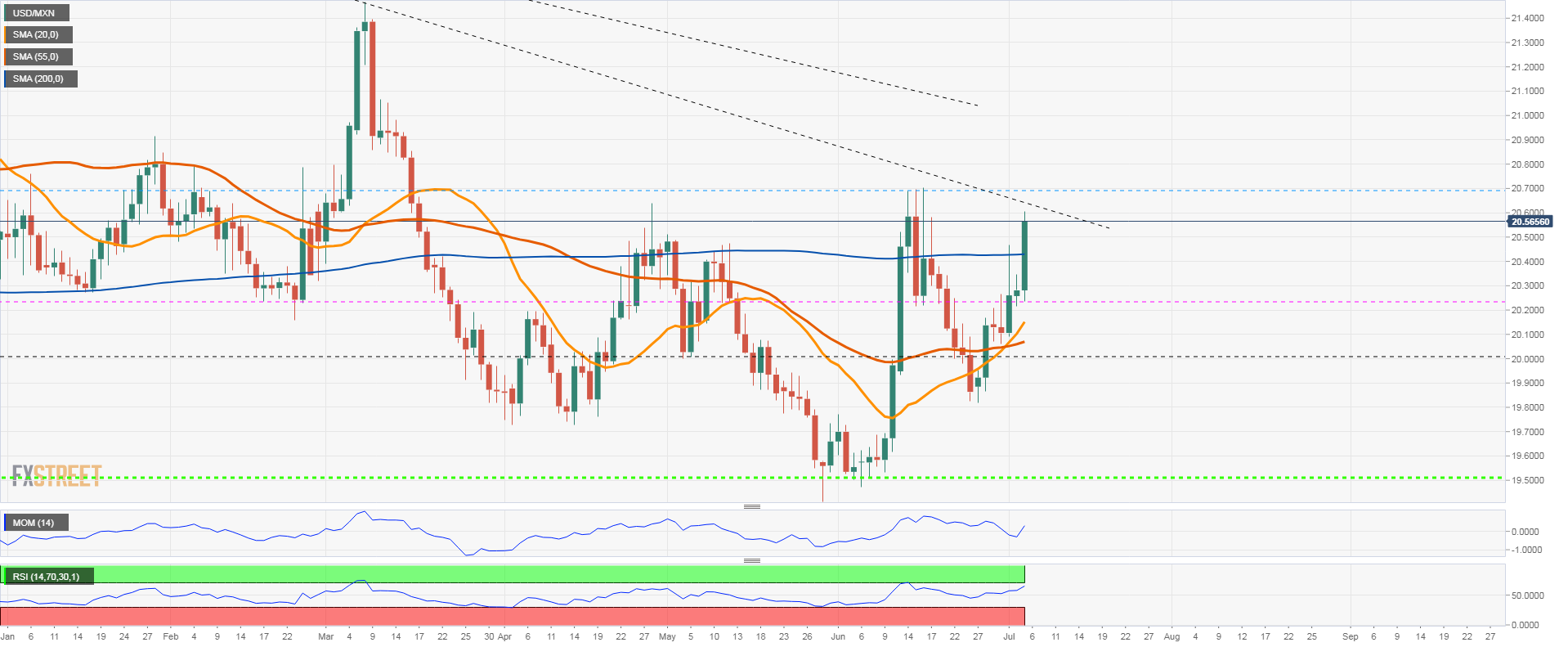

- Next resistance in USD/MXN seen at 20.70.

The USD/MXN accelerated the move to the upside on Tuesday amid a sharp decline in equity markets across the globe. Fears about a recession weighed on Emerging market currencies, pushing the greenback to the upside.

During the American session the USD/MXN peaked at 20.60, the highest level since June 16. It remains near the top, with the bullish pressure still elevated. Some technical indicators are approaching overbought levels, like the daily RIS near 70; however, no signs of exhaustion are seen at the moment.

The next strong barrier is the 20.70 that capped the upside in June. A break higher would open the doors to more gains, targeting 20.90. A slide under 20.45 would alleviate the bullish bias.

Fear drives dollar higher

The greenback is trading at multi-year highs. The US Dollar Index stands at levels not seen since 2002. At the same time, Treasuries are rallying. The US 10-year plummets and stands at 2.79%, while the 30-year is approaching 3%.

The Dow Jones is falling by almost 600 points and the S&P 500 by 1.54%. In Mexico, the IPC index falls by 2%. Among emerging market currencies, the worst performer is the Russian ruble (USD/RUB +10%) followed by the Polish zloty (USD/PLN +2.80%) and the Chilean peso (USD/CLP +2.35% at 950, new record high). Crude oil tumbles nearly 9%.

USD/MXN daily chart