Gold Price Forecast: Fed-led rebound needs acceptance above $1782 – Confluence Detector

- Gold price stalls the recovery amid a bounce in the USD, yields.

- The Fed tapers by $15 billion, stays patient on rate hikes.

- Gold Price Forecast: Firmer bearish case once below 1,756.60.

The Fed’s tapering occurred as expected and triggered a rebound in gold price, as a $15 billion worth of taper was well priced-in. Further, Fed Chair Jerome Powell’s patient stance on the interest rate hikes offered additional zest to gold bulls. However, the renewed upswing in the US Treasury yields amid rising inflation expectations put a fresh bid under the greenback, checking gold’s recovery from a three-week trough of $1759. Attention now turns towards Friday’s US NFP release for fresh gold price direction.

Read: Federal Reserve tapers, Treasury rates rise and markets yawn

Gold Price: Key levels to watch

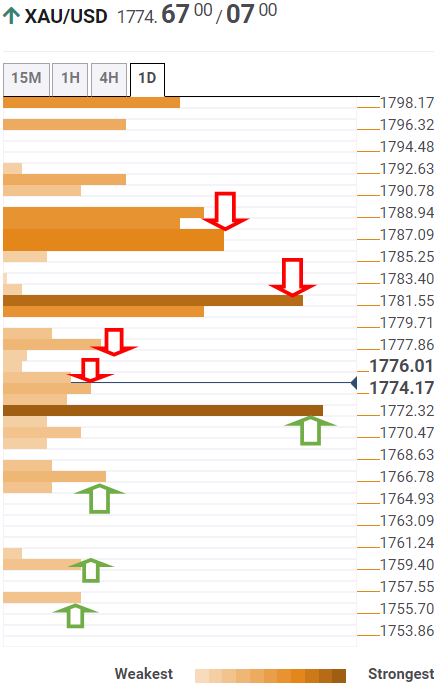

The Technical Confluences Detector shows that gold is easing towards the strong support at $1772, the intersection of the previous week’s low and Fibonacci 61.8% one-month.

The next relevant support is environed at $1770, the Fibonacci 38.2% one-day.

If the downside momentum accelerates, then sellers will target the pivot point one-week S1 at $1767.

The previous day’s low of $1759 will be on the bears’ radars on the extended decline. Further south, the pivot point one-day S1 at $157 will be challenged.

Alternatively, the Fibonacci 61.8% one-day at $1777 will test the immediate upside attempts, above which powerful resistance around $1782 will come into play.

That level is the confluence of the SMA50 one-day, Fibonacci 23.6% one-week and SMA10 four-hour.

A bunch of healthy resistance levels around $1788 is critical for gold bulls to take out should the recovery extend momentum.

The price area is the convergence of the previous day’s high, Fibonacci 38.2% one-month, SMA100 one-day and pivot point one-day R1.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.