Gold Price Forecast: Bears are lurking at key resistance

- Gold has moved into a critical area of resistance head of key US data events.

- The US dollar has collected a safe-haven bid and is on track to extend its recovery.

While in bullish territory, the price of gold is flat in Tokyo and steady at around $1,787 in a narrow consolidative range ahead of key data from the US today.

The yellow metal moved higher on safe-haven accumulation and in a continuation of the firm correction of the heavy sell-off from the $1,800s.

First of all, the disappointing Chinese economic data (July Retail Sales and Industrial Production) was weighing on risk sentiment in Asia on Monday.

Then, there was anxiety over developments in Afghanistan and coupled with ongoing concerns over the impacts of the Delta variant made for a risk-off start to the week that supported gold.

However, against a basket of six major currencies DXY, the dollar was up 0.1% at 92.630 by the North American close after falling to a one-week low of 92.468 on Friday.

The US dollar could be a major headwind for gold prices in the weeks ahead as investors concentrate on the Federal Reserve’s timings for tapering depending on economic data.

The Retail Sales and FOMC minutes this week will be the first chapters in this sense which could prove to be a headwind for the gold price and supportive of the greenback. Hawkish Fed comments are also likely to reassert themselves in the market this week.

Gold & DXY technical analysis

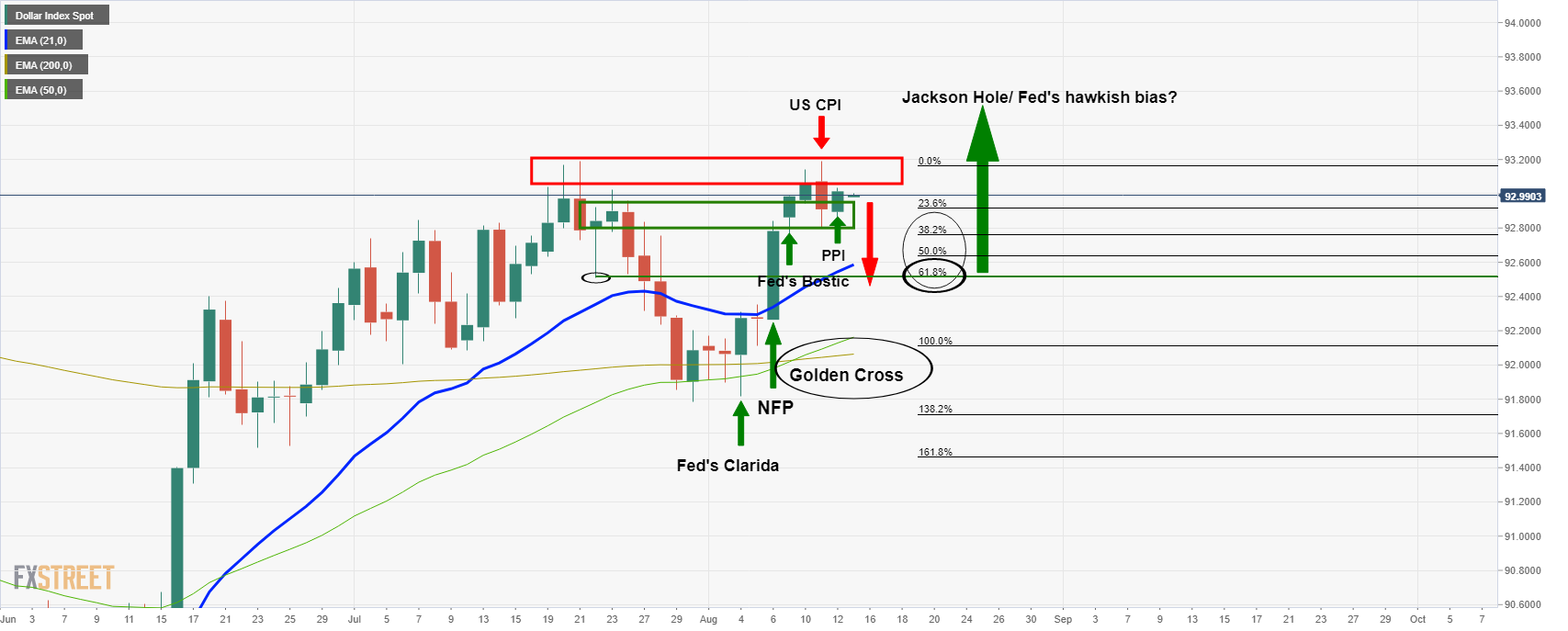

In a prior analysis, US dollar teases reversal traders, Golden Cross underpins, it was anticipated that there would be some let-up in the greenback's strength ahead of the Jackson Hole:

However, the deterioration was fast on the back of bad data on Friday immediate:

It was stated that there would be a bias to the upside while above 92.351 which will be a headwind for the gold price going forward.

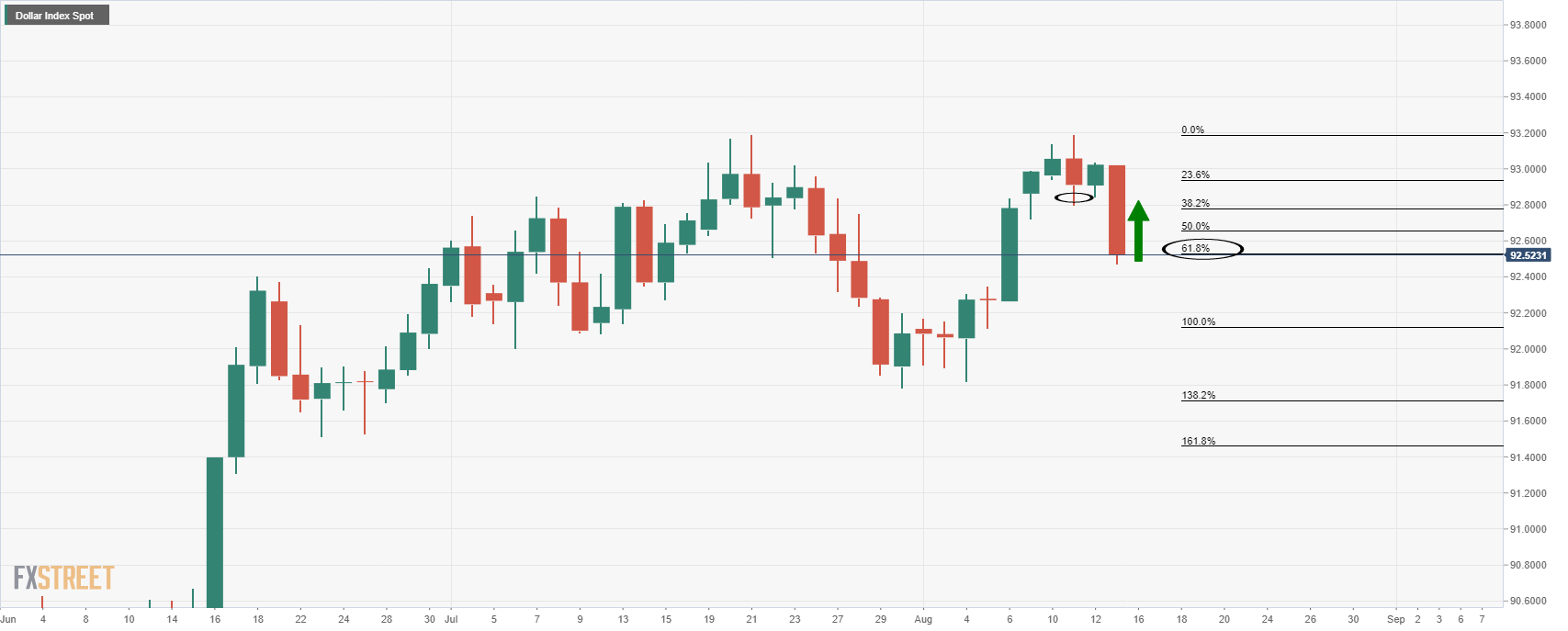

The market is making tracks as anticipated:

It was also explained that gold was headed towards prior support and a test of the 78.6% Fibo at 1,798 as follows:

While the price has made headway, there are still $10 to go to the upside:

A break of resistance opens risk back into the 1,800s.

However, failures will likely lead to a downside continuation of the broader bearish trend. 1,677 will be key in this regard.