EUR/USD bulls coming up for their last breath ahead of ECB?

- EUR/USD bulls come up for air ahead of the ECB where bias is skewed to the downside.

- US dollar has been set back as investors get behind risk assets again despite Delta covid concerns.

At the time of writing, EUR/USD is trading at 1.1801 and up some 0.2% into the closing bell on Wall Street.

The single unit travelled from a low of 1.1751 to a high of 1.1804 on the day following weakness in the greenback and as traders get set for the European Central Bank on Thursday.

On Wednesday, the safe-haven dollar fell back from the three-month highs as US stocks rallied despite caution pertaining to inflation fears and concerns about the highly contagious Delta variant.

By the close of New York trading, the dollar index, a measure of its value against six major currencies was lower at 92.758, DXY.

On Tuesday, the index hit a more than three-month high.

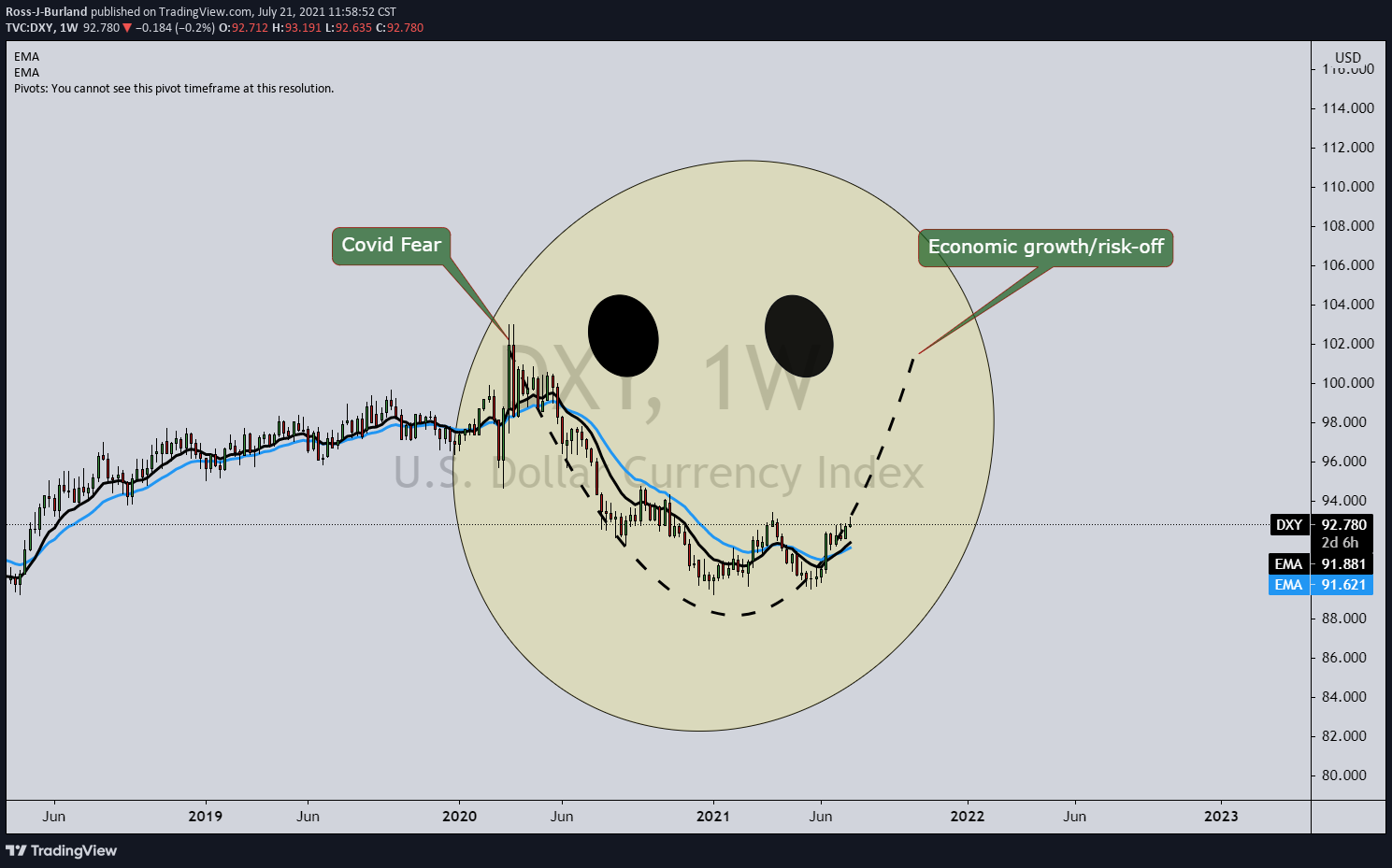

However, market participants remain bullish on the dollar's outlook and the US dollar smile theory is in play.

That is to say, strong US data are feeding into increased dollar bullishness as the Fed continues to take tentative steps towards tapering. Coupled with the risks of the delta variant and prospects of lower global yields, the greenback can be continued to be favoured.

Meanwhile, with no major data out, the focus is very much on the ongoing fiscal debate in the US, and Thursday’s ECB meeting.

''The end of the temporary suspension to the US debt cap could be a source of uncertainty and volatility, with Democrats and Republicans needing to approve an increase in the debt ceiling to avoid another government shutdown,'' analysts at ANZ bank argued.

With respect to the ECB meeting, the analysts say that it should help to clarify the ECB’s new inflation target.

However, the conclusion of the ECB strategic review means the distribution of probabilities is skewed to lower EUR/USD.

Markets are expecting a more dovish bias and that would imply a total reduction of the monthly purchases in 2022.

Such an outcome would be less than previously expected and would be expected to weigh on the EUR/USD for the foreseeable future and into 2022 when considering the ECB-Fed divergence.