EUR/JPY Price Analysis: The bulls are digging in their heels

- EUR/JPY bulls are stelling in and the price could be due for an upside continuation.

- The US stock market is on firmer ground as investors move in at a discount following Monday's blood bath.

EUR/JPY is on the up as traders get back behind the US stock market in a slightly firmer risk tone on Tuesday,

Profit-taking has likely played a role in the bid considering the huge sell-off a the start of the week.

The cross is benefitting due to its high beta nature as Investors begin to rationalise that fears of another crippling round of global lockdowns are potentially overblown.

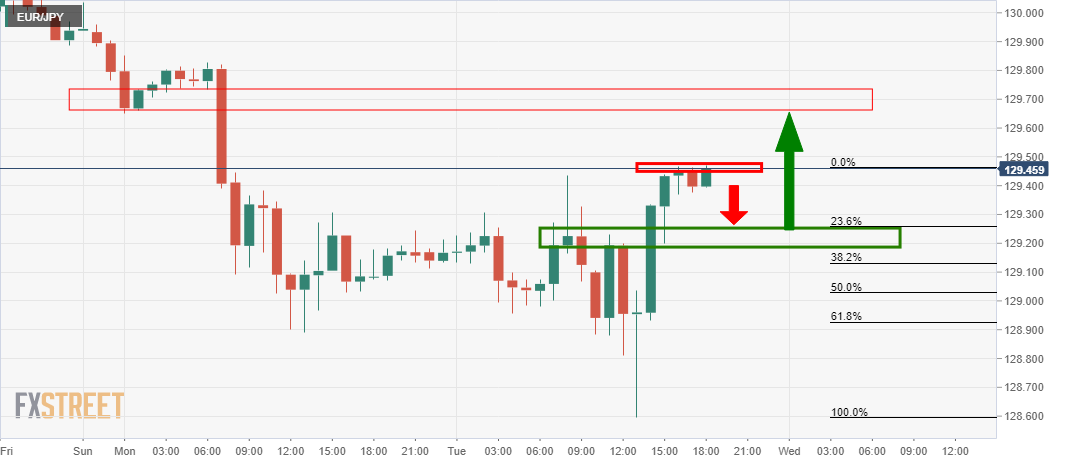

EUR/JPY hourly scenario 1

Should the price stall at this resistance and correct in a drift to the downside, then the 23.6% Fibonacci retracement and correlation with prior resistance structure could be a solid area of support.

Below there the 38.2% Fibonacci could be the last defence before an onwards bullish continuation from which would present a bullish trading opportunity to target the next resistance structure between 129.65/80.

EUR/JPY hourly scenario 2

However, the bulls are firming up in the current trade and the bulls are sticking in their heels. This could result in a break of the current resistance near 129.50.

A break and close above would be bullish and create the next bullish structure from 129.50. On a retest of the structure, bulls could be lurking for a longing opportunity towards the 129.65/80 targets area.

Supporting the bullish outlook, the S&P 500 is headed higher at the time of writing and there is a close correlation between EUR/JPY and the US stock market:

S&P 500 15 min chart

-637624036579306891.png)