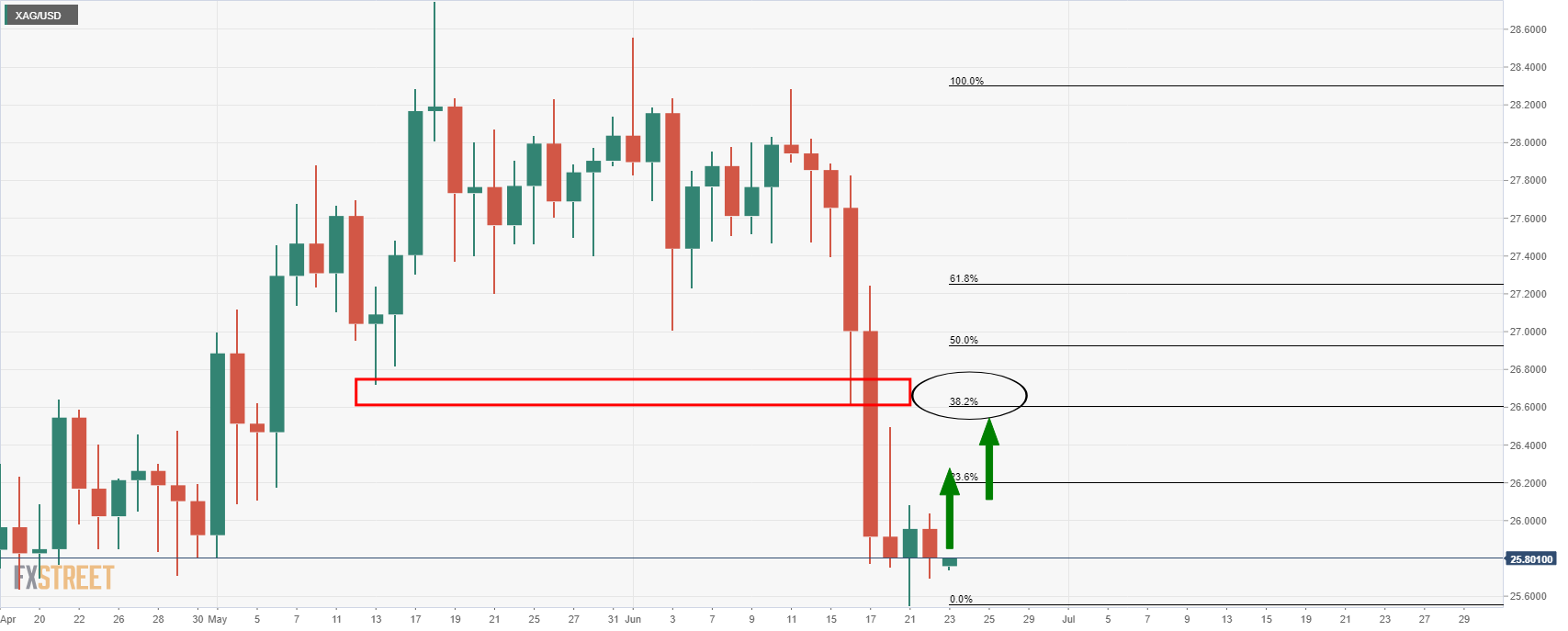

Silver bulls eye a move to the daily 38.2% Fibo

- Silver is firming at critical support and bulls look to the 38.2% Fibo and prior structure.

- Fed speakers dampened the hawkish theme at the Fed, weighs on the US dollar.

At the time of writing, silver is firmer around the daily bullish dynamic trendline support and trades 0.14% higher on the day so far.

XAG/USD is trading at 425.80 and has travelled in a tight range between $25.77 and $25.81.

Silver, however, was on the back foot on Tuesday with XAG/USD down at $25.77 after losing the $26 handle and dropping to a low of $25.69. Industrials were under pressure with both iron ore and copper lagging the general commodities complex. Further concerns of government intervention weighed on iron ore prices.

A host of Fed officials were talking down the likelihood of higher interest rates. It seems last week’s price action went too far with the chair Powell testifying before Congress, where he vowed that the Fed will not raise rates out of fear of potential rising inflation.

The US dollar dipped as Powell spoke, with the dollar index falling 0.20% to 91.733. The index is now holding below a two-month high of 92.408 reached on Friday.

Fed Chair, Jerome Powell, said that a debate on tapering may be on the cards, they are nowhere near to raising rates. Powell's remarks pushed yields on benchmark 10-year Treasuries lower, dipping to yield 1.4649% after clearing 1.5% earlier in the day.

Other speakers, such as Cleveland Fed President Loretta Mester who said that now is not the time to end accommodative policies, helped to improve risk appetite.

Meanwhile, New York Fed President John Williams argued that there is still plenty to go until full employment. Williams said a rate rise is a “way off” and he expects inflation will fall back to 2.0% next year. San Francisco Fed President Mary Daly argued that the conditions for tapering may be met later this year or early next year.

Silver price analysis

The technical outlook is looking consolidative for the sessions ahead as the price holds at the daily lows. A correction to the 38.2% Fibo could be on the cards at 26.58.