MVIS Stock Price: Microvision Inc the new meme king does what meme stocks do pumps and then dumps

- Microvision (MVIS) is the king for retail traders.

- MVIS exhibiting huge volatility and price spikes.

- MVIS shares closed down 24% on Tuesday.

Microvision is a Washington based technology company making sensors and microdisplays. The primary business is developing laser beam scanning technology. The company has a market cap. of $3.2 billion and a high short interest of 20%. Sound familiar!

MVIS stock news

MVIS shares have captured the retail zeitgeist and are in line to dethrone GameStop as the retail tool of choice for speculative volatility. MVIS has been the top trending stock on wallstreetbets this week and with price swings like this, it is easy to see why. MVIS shares are up 274% in 2021, and counting. MVIS is up 94% in the last week, 726% in the last 6 months, and wait for it 7909% in the last year. Nice if you can buy at the bottom and sell at the top.

All this meets the wallstreetbets criteria of highly volatile, highly speculative stocks. Most seasoned investors shy away from such volatility preferring more sustainable, identifiable businesses. But then older is always more cautious. The new breed of young trader wants volatility, wants action even if that can spell disaster as well as profits. Hey it is your party.

MVIS has overtaken GameStop on wallstreetbets this week with 2,451 mentions against GameStops 918 according to data from Quiver Quantitative. This is despite GameStop (GME) not exactly going along quietly as it produced some pretty serious price moves also this week.

-637551997205104013.png)

Quiver Quantitative

Just to give some perspective on the hype, this is as per usual not a profitable company. MVIS lost $13.6 million in 2020, $26.4 million in 2019, $27 million in 2018, $25 million in 2017 and $16 million in 2016. The company has been raising cash and diluting existing shareholders as it does so with the share counting increasing nearly 50% in the last 3 years.

So if you choose to invest in this just know what you are getting into. You are getting into a speculative hype and frenzy for the short term. That is not a problem, volatility provides opportunity so long as you manage your risk accordingly.

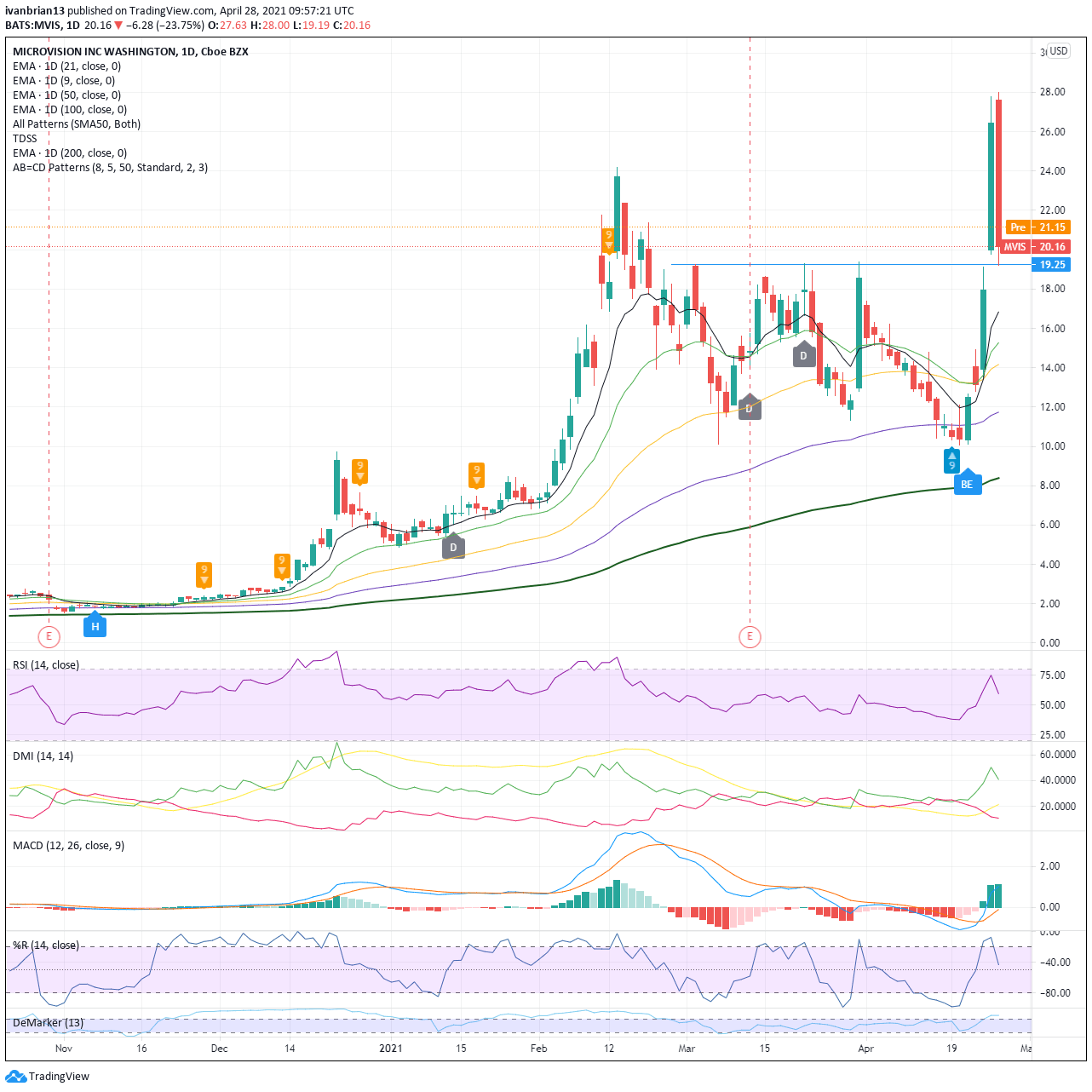

So let us look at the chart from some key level to help manage risk and trade the volatility.

Price is elevated and so is volatility. The huge breakout has immediately been slammed by an ugly bearish engulfing candle. The RSI is very close to overbought levels and has been above overbought levels on Tuesday. Williams oscillator is also showingg close to overobught levels. The MACD has crossed over into a bullish signal, this hd to happen given the perice explosion.

$19.25 is key support as above this MVIS remains bullish. This is where the price has broken out from and gapped up in price. Tuesday also saw MVIS just about stall on the way back down, bottoming out at $19.19. A break of this will see a quick move to the 9-day moving average support at $16.85 and then the 21-daya t $15.28.

The first target to the upside is $28 and then $30.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.