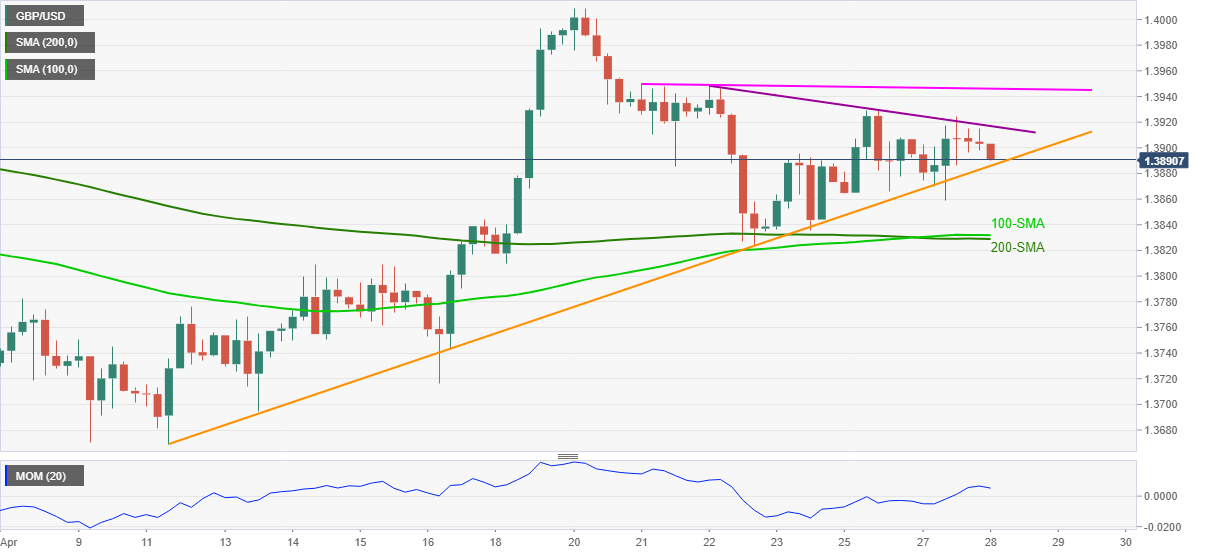

GBP/USD Price Analysis: Drops towards two-week-old support line near 1.3900

- GBP/USD snaps three-day run-up as sellers attack intraday low.

- 100, 200-SMA confluence can test the bears amid upbeat Momentum.

- Weekly resistance line guards short-term upside ahead of 1.3950 horizontal hurdle.

GBP/USD stays pressured around the intraday low of 1.3890, down 0.12% on a day, during Wednesday’s Asian session. In doing so, the cable keeps Tuesday’s U-turn from a one-week-old resistance line while snaps a three-day uptrend.

Although sustained trading below the short-term resistance line keeps GBP/USD sellers hopeful, an ascending support line from April 12 and price-positive moves of the Momentum line suggests limited downside of the pair unless breaking 1.3885 level.

Also likely to challenge the sterling bears is the convergence of 100 and 200-SMA near 1.3830.

Meanwhile, an upside clearance of the immediate hurdle around 1.3920 should escalate the recovery moves towards a short-term horizontal area surrounding 1.3945-50.

If at all the GBP/USD buyers manage to cross 1.3950 resistance, the monthly top near 1.4010 will be in the spotlight.

GBP/USD four-hour chart

Trend: Further weakness expected