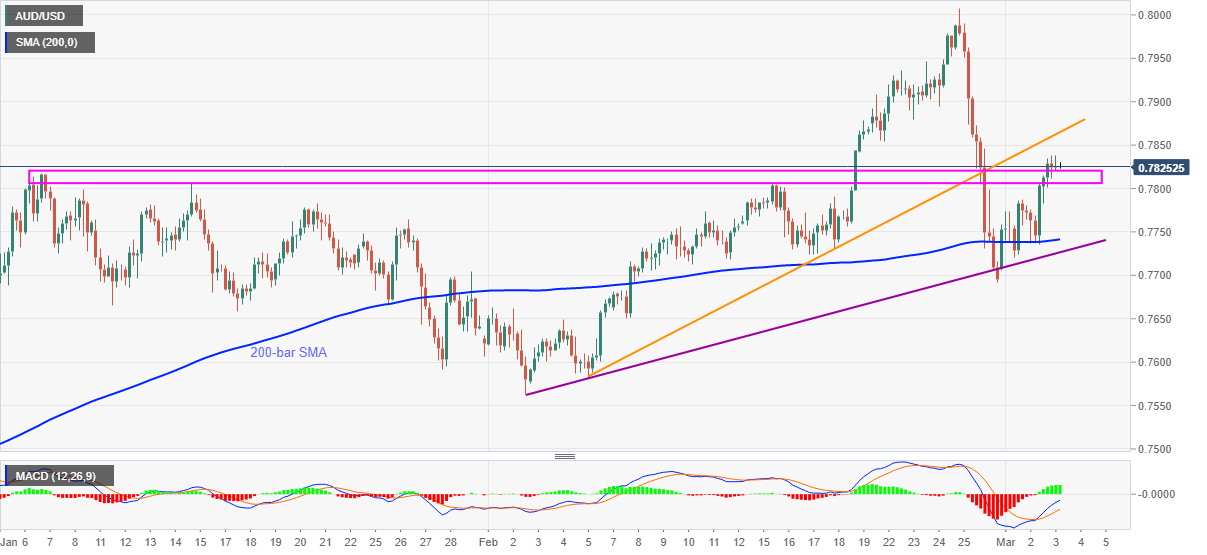

AUD/USD Price Analysis: Remains sluggish around key hurdles above 0.7800

- AUD/USD seesaws in a choppy range near weekly top.

- Two-month-old horizontal area offers immediate support, previous hurdle from February 05 guards nearby upside.

- Bullish MACD backs recent recovery from short-term support line, 200-bar SMA.

AUD/USD takes rounds to 0.7830 amid the early Wednesday. The pair recovered so far during the week before pausing the run-up off-late. In doing so, the quote gives a sober reaction to the upbeat Aussie Q4 GDP and weak China Caixin Services PMI.

Even so, the pair’s successful trading above a broad horizontal hurdle established since early January, as well as strength beyond the key SMA and one-month-old support line, favor the AUD/USD buyers.

That said, the previous resistance line from February 04, at 0.7865 now, seems to lure short-term buyers of the AUD/USD ahead of directing them to the 0.7900 round-figure.

In a case where bulls keep the reins past-0.7900, the 0.7930 becomes a buffer ahead of the yearly top surrounding 0.8010.

If at all the AUD/USD prices slip below the immediate support zone occupying the 0.7820-05 area, 200-bar SMA and short-term support line, respectively near 0.7740 and 0.7725, should test the sellers.

However, sustained weakness below 0.7725 may eye the previous week’s low near 0.7690 before confirming the downside to the sub-0.7600 region.

AUD/USD four-hour chart

Trend: Bullish