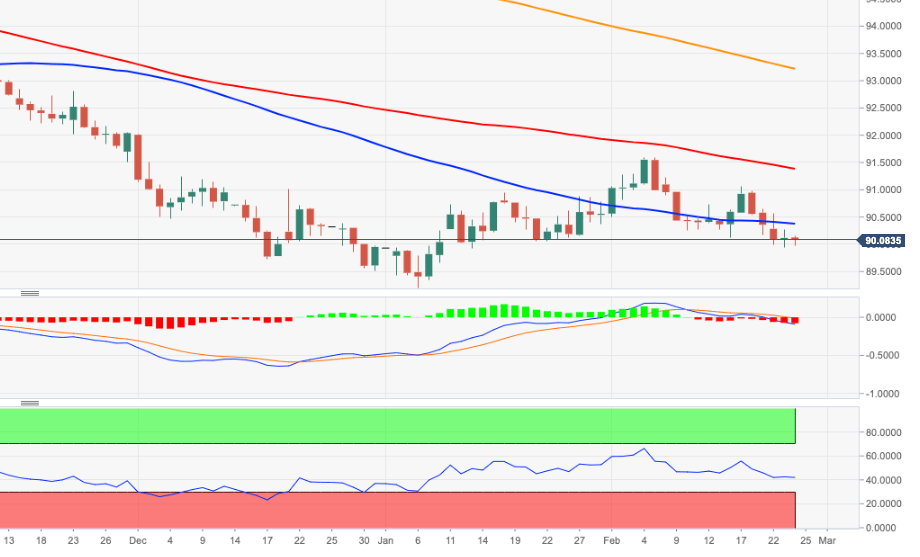

US Dollar Index Price Analysis: Looks neutral/bearish near-term

- DXY extends the consolidative mood around 90.00.

- Further south of this level comes in the 2021 lows at 89.20.

DXY keeps the rangebound trading in the 90.00 region, always supported by the key 2020-2021 support line (near 89.80).

While further consolidation around this area is not ruled out, the psychological support at 90.00 emerges as a crucial barrier for USD-sellers. A breakdown of this zone should open the door to a probable move to the 2021 lows around 89.20 (January 6) ahead of the March 2018 low at 88.94.

In the meantime, occasional bouts of upside pressure in the index are deemed as corrective only amidst the broader bearish view on the dollar. That said, bullish attempts to the 91.00 hurdle and beyond could represent selling opportunities against the current backdrop.

In the longer run, as long as DXY trades below the 200-day SMA (93.21), the negative stance is expected to persist.

DXY daily chart