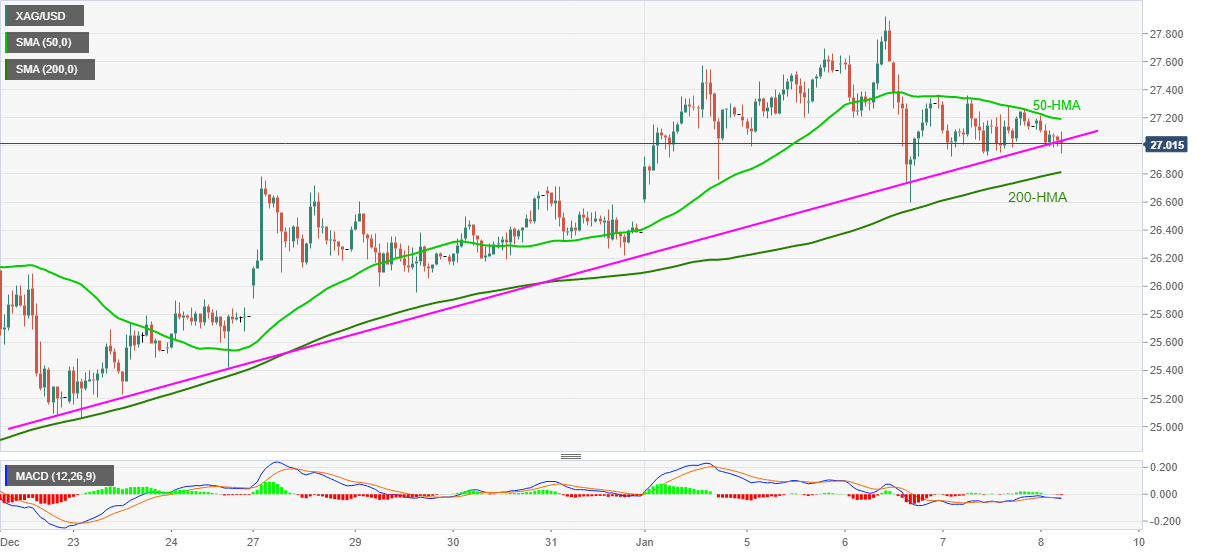

Silver Price Analysis: XAG/USD sellers attack 13-day-old support line

- Silver probes intraday low, drops for the third consecutive day.

- Sustained trading below 50-HMA, bearish MACD favor sellers, 200-HMA adds filters to the downside.

Silver declines to $26.97, down 0.70% intraday, during the pre-European session trading on Friday. The metal has been pressured for the last three days and is currently challenging an upward sloping trend line from December 22.

Considering sluggish MACD and RSI conditions, not to forget extended trading below 50-HMA, silver is likely to break the immediate support line around $26.95 and test the 200-HMA level of $26.81.

While late-December top near $26.78 offers additional support, a break of which may not hesitate to conquer the $26.00 round-figure.

Alternatively, an upside break of 50-HMA, currently at $27.20, will have multiple resistances near $27.40 and $27.65 ahead of challenging Wednesday’s high of $27.92.

During the silver buyers’ dominance past-$27.92, September 2020 peak surrounding $28.90 and the $29.00 can offer intermediate stops before pushing them to the year 2020 high of $29.85.

Silver hourly chart

Trend: Further weakness expected