Back

19 Oct 2020

Crude Oil Futures: Extra downside appears shallow

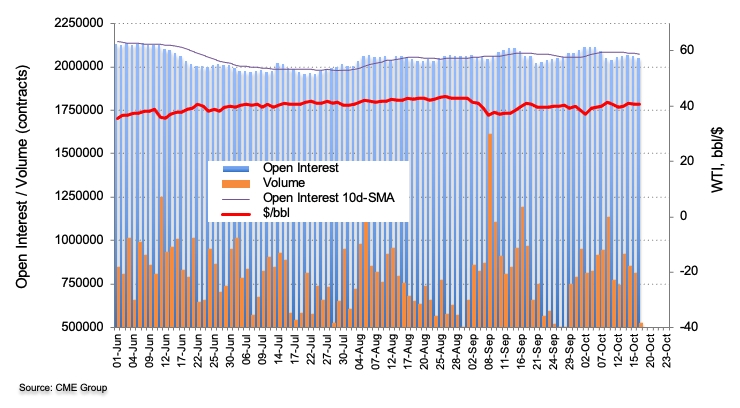

CME Group’s flash data for Crude Oil futures markets noted open interest shrunk for the second session in a row on Friday, this time by nearly 7K contracts. In the same direction, volume went down for the third session in a row, now by around 292.2K contracts.

WTI: Upside still faces resistance around $41.50

Prices of the WTI trades within a mild downtrend so far. However, Friday’s inconclusive performance was amidst shrinking open interest and volume, supporting the idea of shallow pullbacks and leaving a potential rebound in the pipeline. That said, the $41.50 level still emerges as a key barrier for oil bulls.