USD/MXN breaks under 24.00, hits nine-day lows

- Emerging market currencies rise sharply versus US dollar on Wednesday, before FOMC decision.

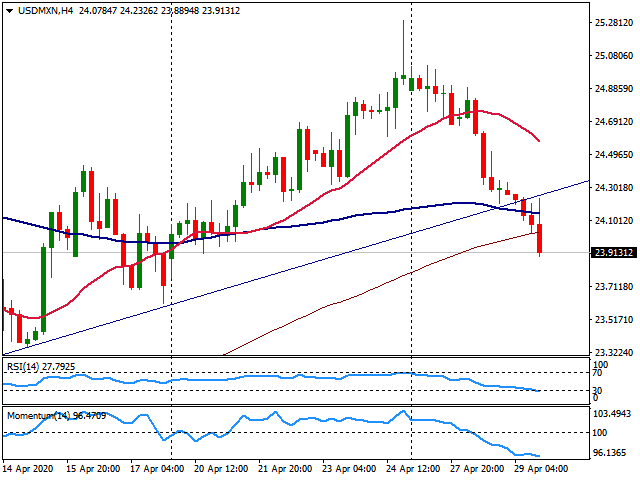

- USD/MXN falls for the third day in a row, below the 20-day moving average.

The USD/MXN broke below 24.00 and fell to 23.88, reaching the lowest level since April 20. It is falling for the third consecutive day as it continues to correct lower from 25.30 (last week high).

The greenback is falling versus emerging market currencies on Wednesday amid an improvement in market sentiment. Equity prices are higher in Wall Street. The Dow Jones gains 2.06% and the Nasdaq 2.96%. Optimism comes from several governments planning to gradually exit the lockdowns. Also after Gilead mentioned a treatment for coronavirus met the main goal.

Economic data from the US showed the terrible economic consequences but had a limited impact on markets. During the first quarter, GDP contracted by 4.8%. The worst reading since the 2008 financial crisis.

The greenback is falling particularly against emerging market currencies. Among the last ones, the South African rand (USD/ZAR -1.98%) and the Brazilian real (USD/BRL -1.75%) are the top performers.

USD/MXN technical outlook

The pair is trading near the lows, under pressure and technical indicators point to further losses. The next strong support is seen around the 23.70 area, the next target.

The USD/MXN is back below the 20-day moving average, today at 24.15 and it broke a short-term uptrend line. A recovery above 24.30 would alleviate the bearish pressure.