USD/MXN Price Analysis: Mexican peso fails to keep Monday’s gains

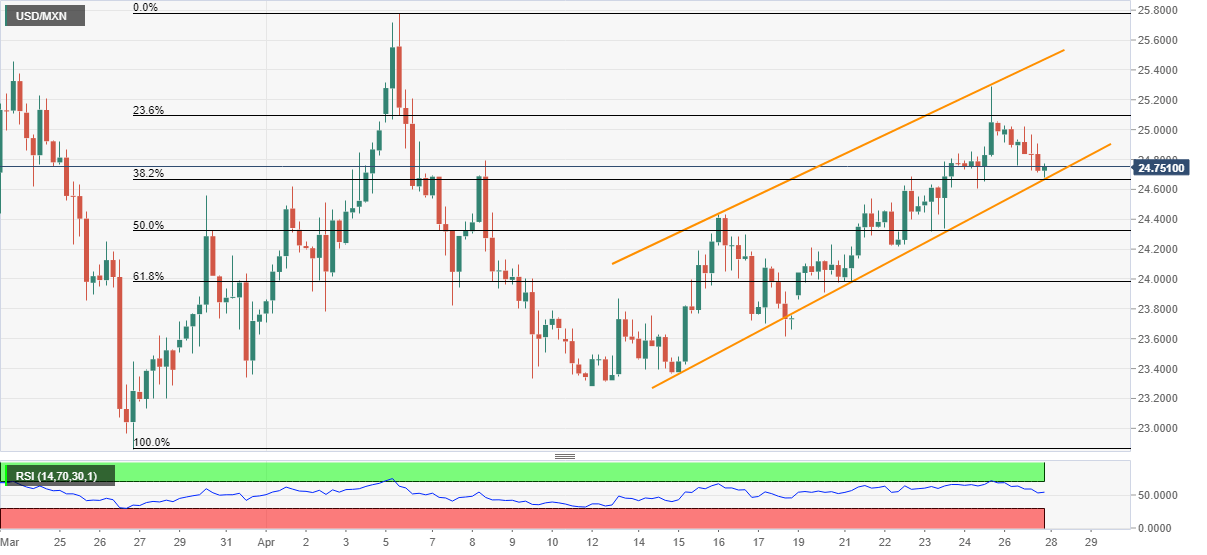

- USD/MXN bounces off short-term ascending channel’s support, 38.2% Fibonacci retracement.

- Mid-month high offers additional downside filter.

- Further upside needs to cross the channel’s resistance line ahead of probing the monthly high.

USD/MXN defies the previous day’s pullback while rising 0.20% on a day to 24.75 amid the early Asian session on Tuesday.

While overbought RSI conditions could be traced as a reason for the pair’s week-start pullback, support-line of a two-week-old rising trend line and 38.2% Fibonacci retracement of March 26 to April 06 upside, near 24.65, seems to have triggered the quote’s latest bounce.

That said, the pair currently witnesses recovery moves towards 25.00 and then to the 23.6% Fibonacci retracement near 25.10.

However, the upper line of the said channel, currently near 25.50, could then challenge the buyers targeting to refresh the monthly top of 25.78.

On the downside, the pair’s break of 24.65 can quickly fetch the quote to April 16 high close to 24.40 ahead of highlighting 61.8% Fibonacci retracement level of 23.98 for the sellers.

USD/MXN four-hour chart

Trend: Bullish