Back

25 Feb 2020

USD/JPY Price Analysis: Dollar extends losses as market fears embolden yen

- USD/JPY is retracing down for the third day in a row after last week’s massive bullish breakout.

- The level to beat for bears is the 109.80 support.

- Coronavirus fears are sending markets in risk-off mode, attracting investor to buy yen.

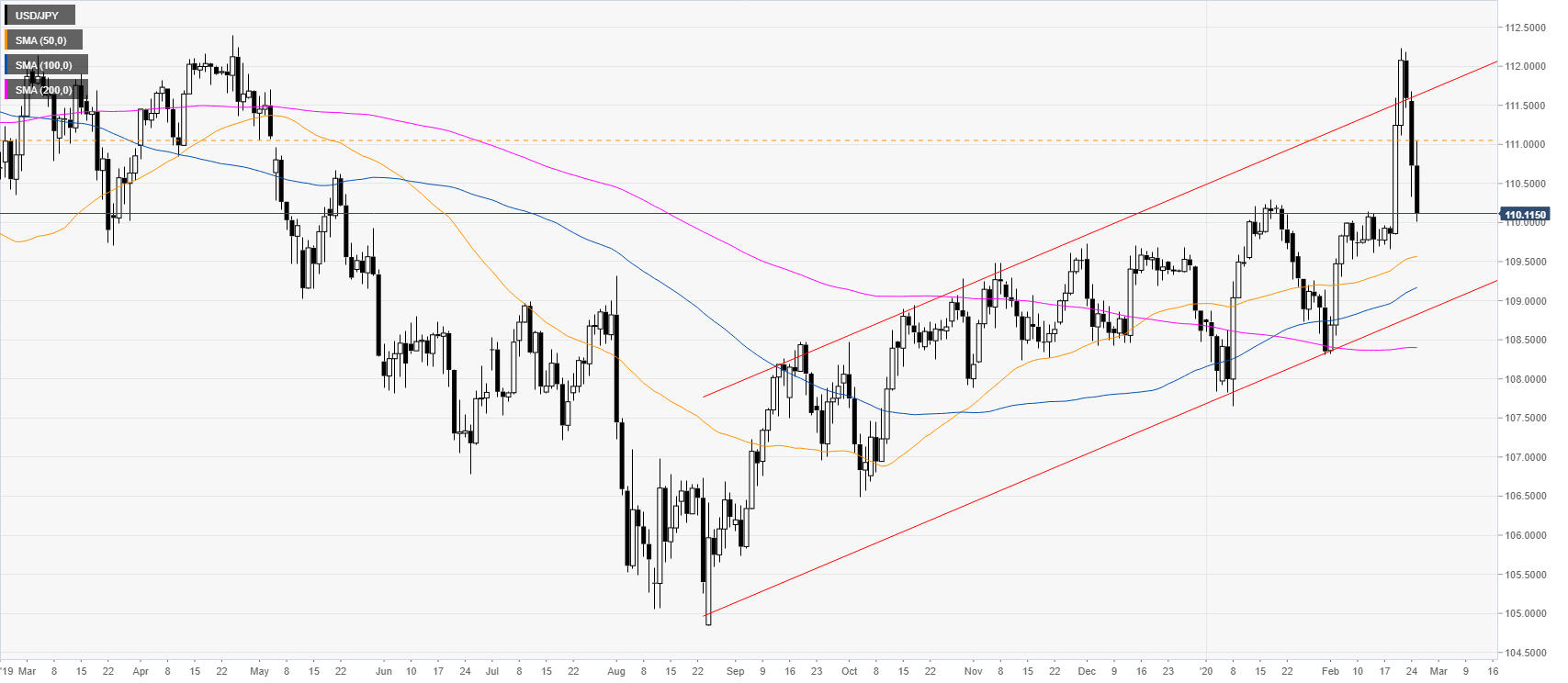

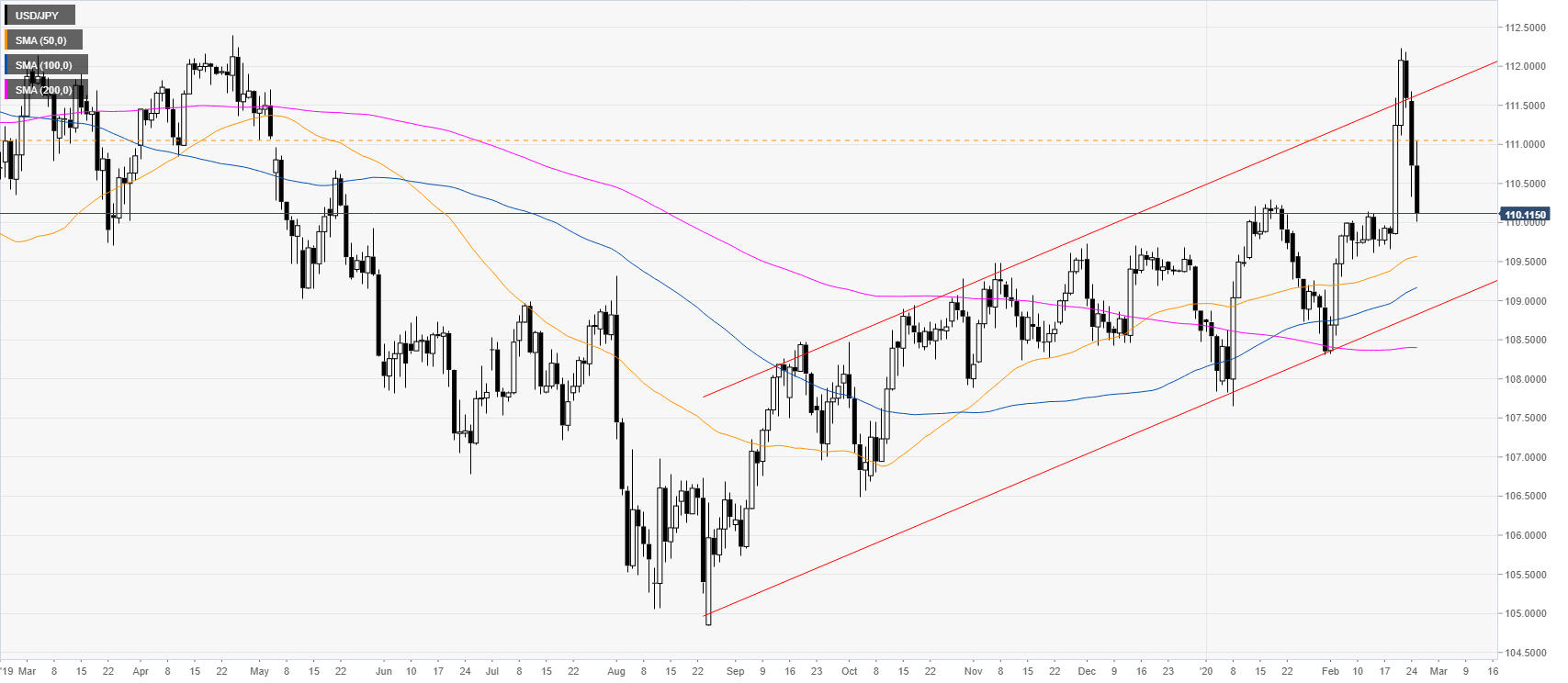

USD/JPY daily chart

USD/JPY is trading in an ascending channel while above the main daily simple moving averages (SMAs). The quote is correcting down after a massive breakout last week. As the Coronavirus is spreading the markets are entering risk-off mode, increasing the demand for yen.

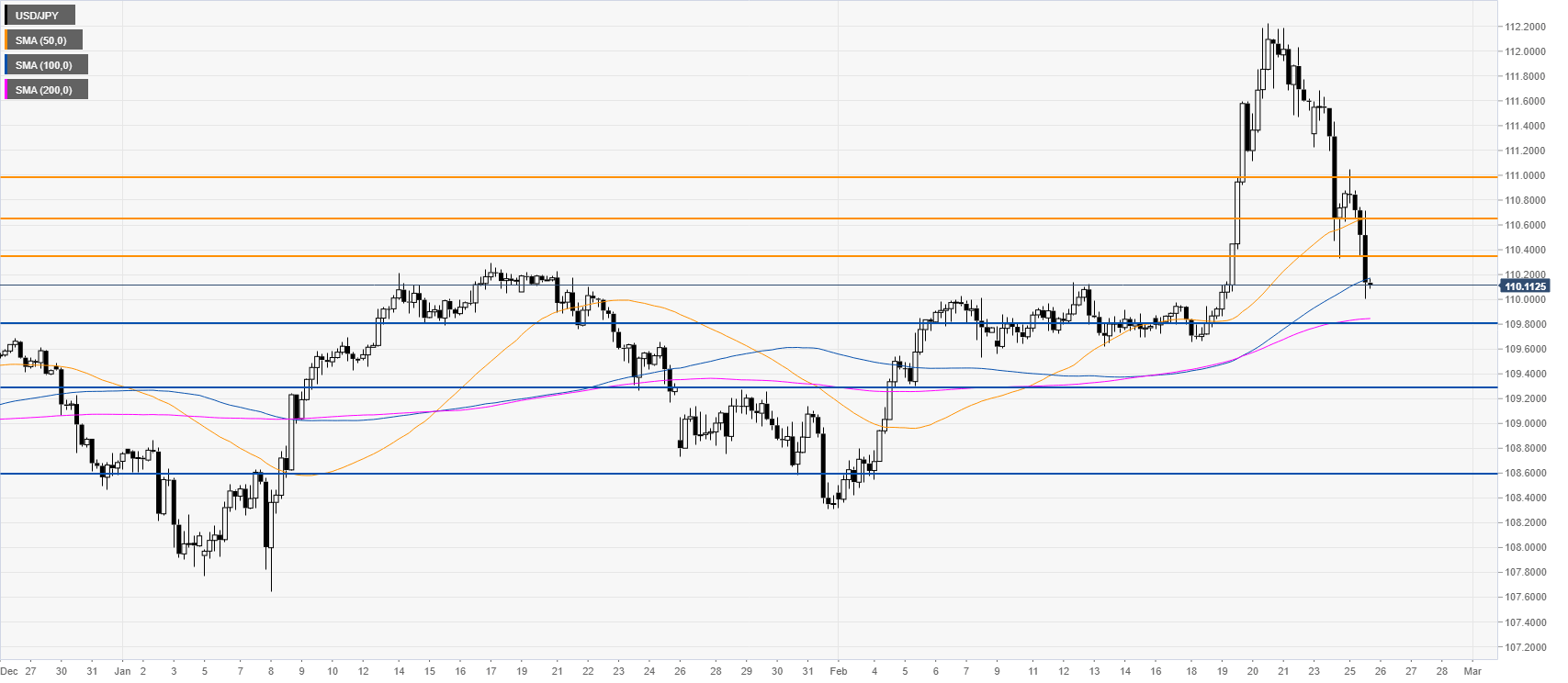

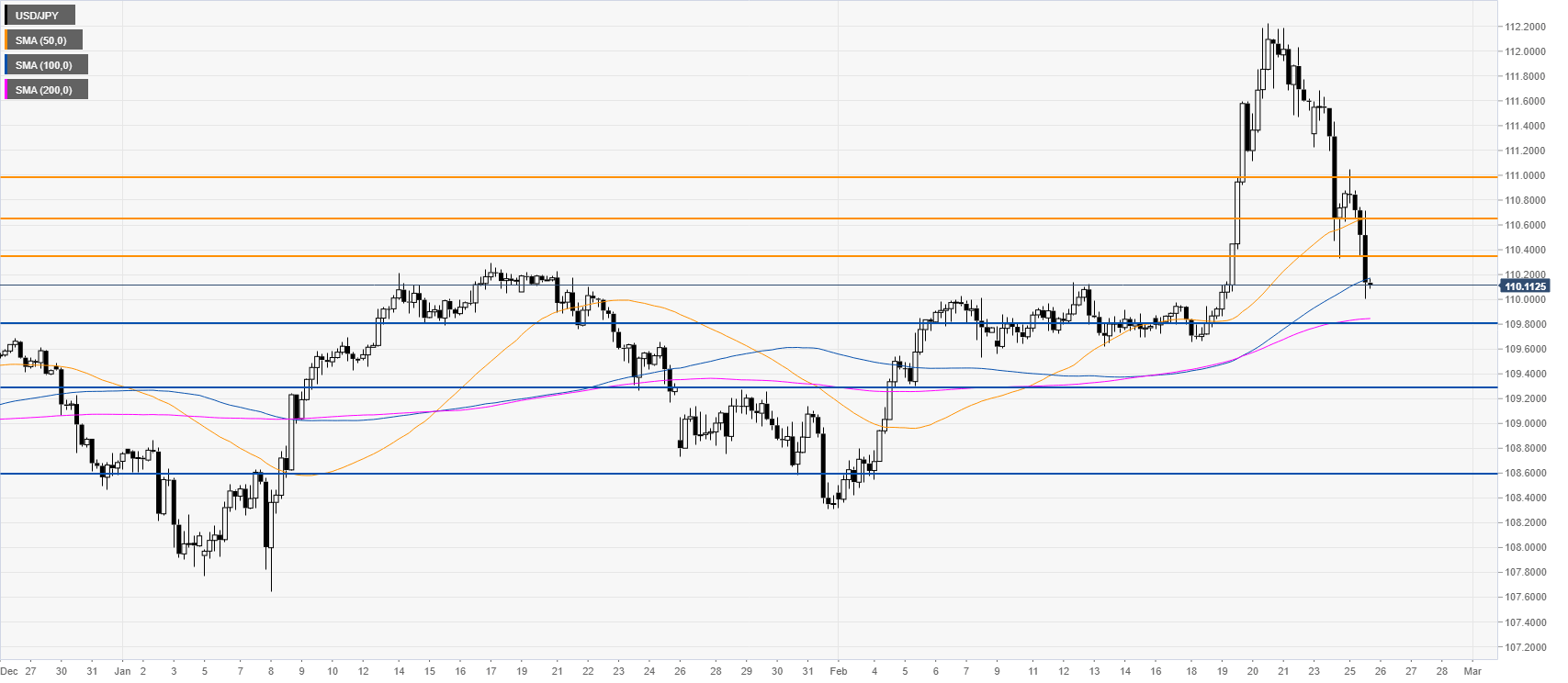

USD/JPY four-hour chart

As expected the spot broke below the 110.65/35 support zone opening the gates to a deeper pullback down towards the 109.80 and 109.30 levels. The 110.65/35 support zone is now turning resistance and could weather bullish attempts.

Resistance: 110.65, 110.35, 111.00

Support: 109.80, 109.30, 108.60

Additional key levels