Back

23 Jan 2020

US Dollar Index Price Analysis: DXY bulls nearing the 97.85 resistance

- The inverse head-and-shoulders pattern is keeping the bullish bias intact.

- Upside targets can be located near 97.85 and 98.20 levels.

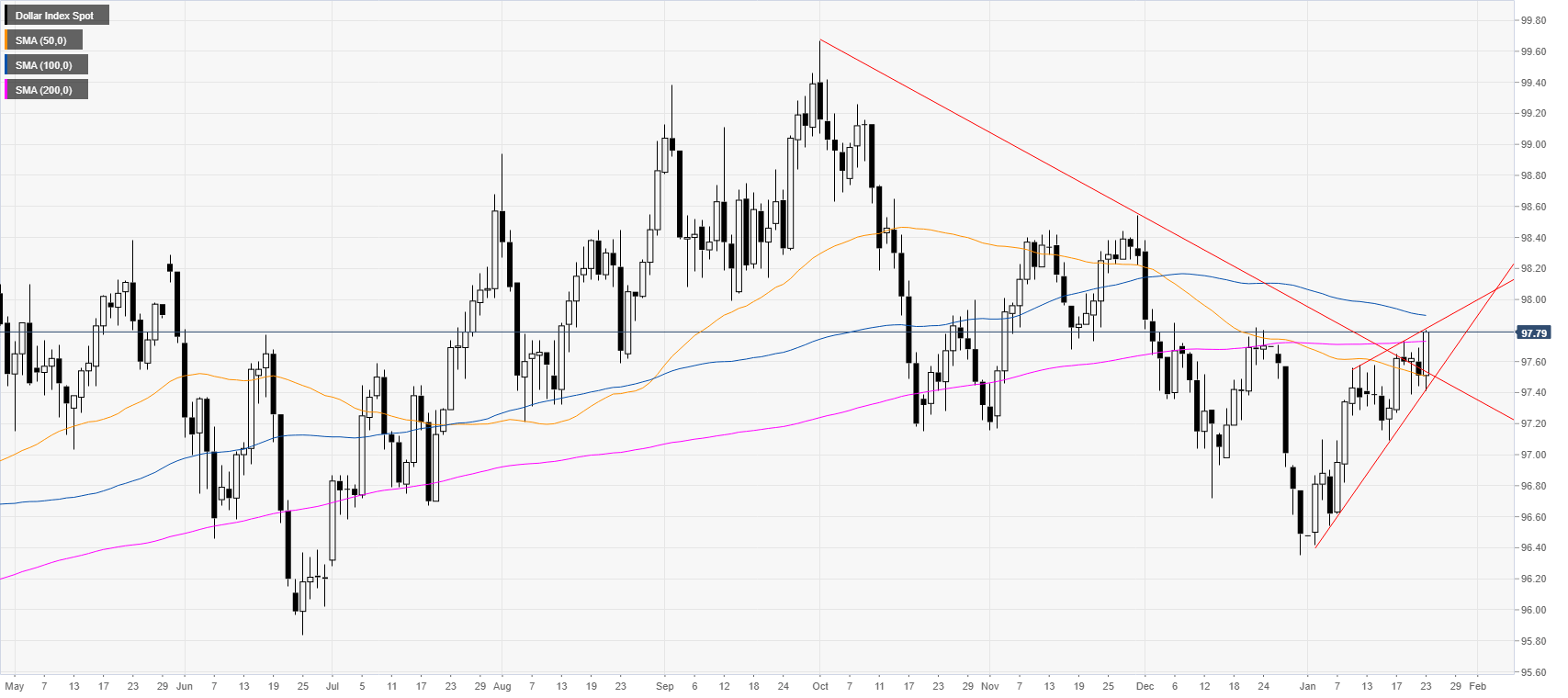

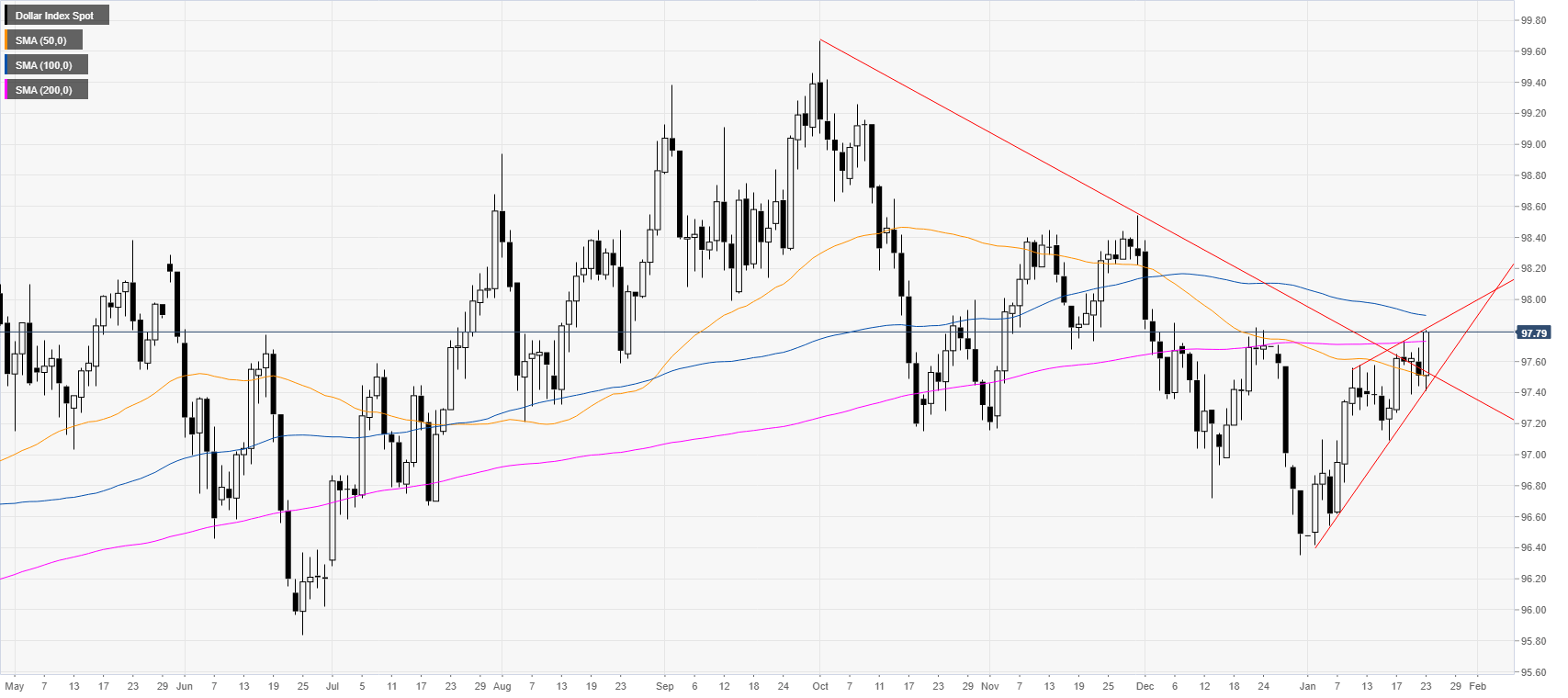

DXY daily chart

The US dollar index (DXY) is challenging the 200-day simple moving average (SMA) while trading within a rising wedge channel. The ECB press conference weighed on the euro and lifted the US dollar index.

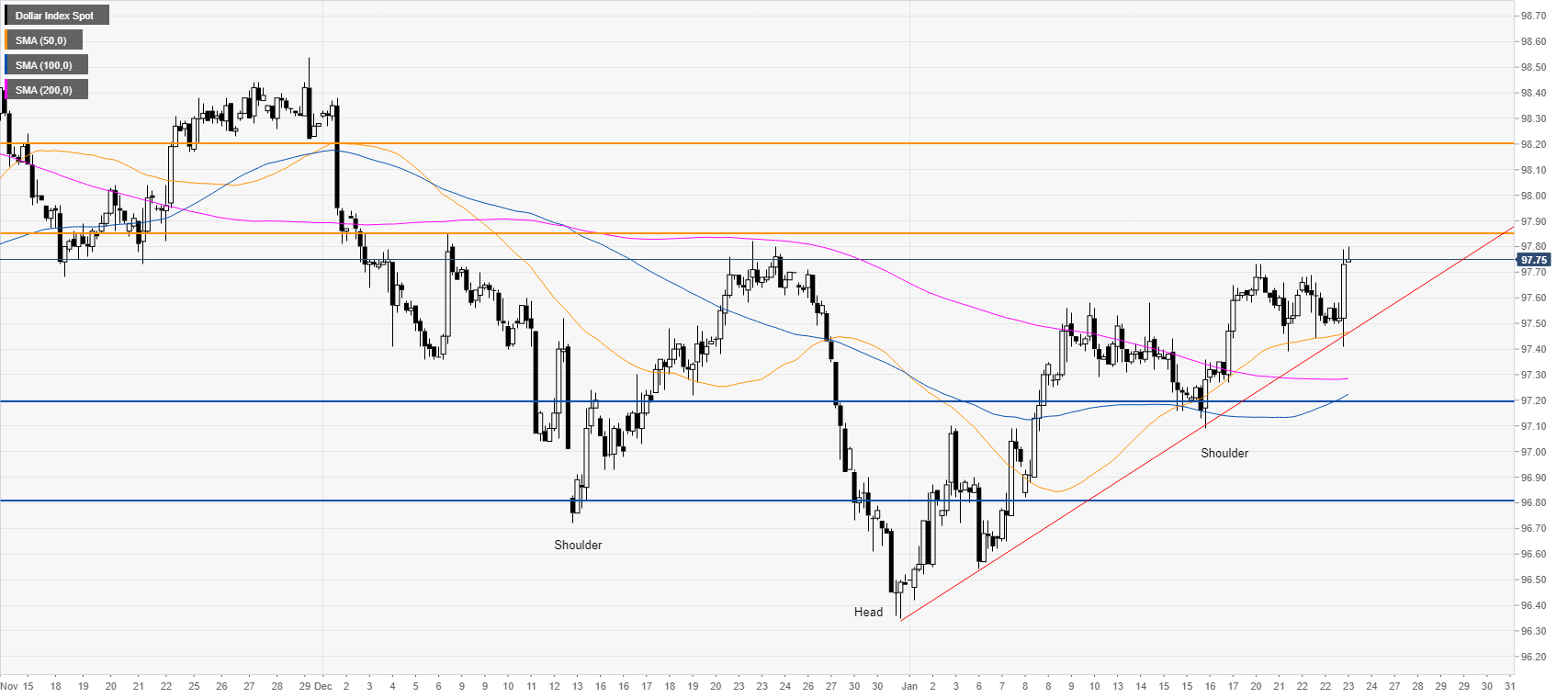

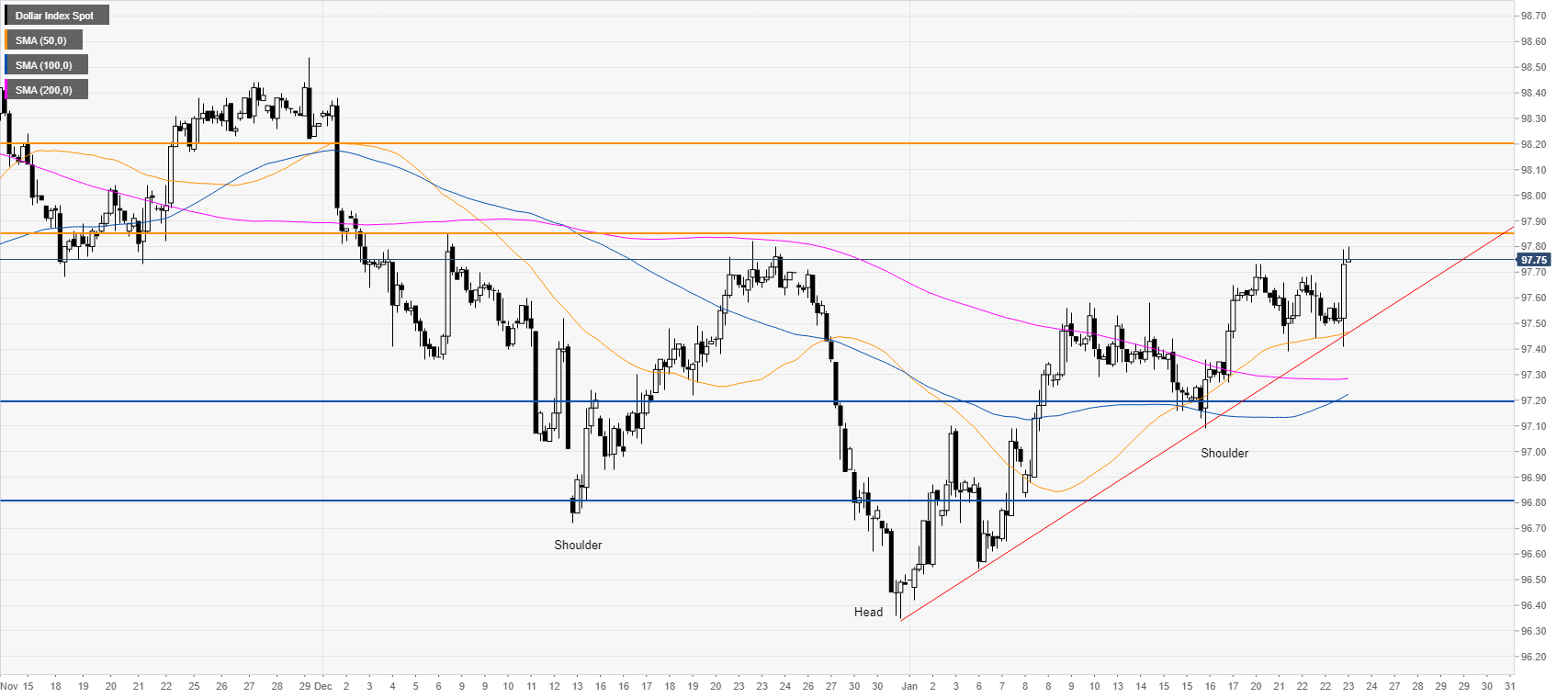

DXY four-hour chart

DXY is trading above the main simple moving averages (SMAs) and a bullish trendline, suggesting a constructive bias in the medium term. The greenback is equally in an inverted head-and-shoulders pattern which is lifting the market towards the 97.85 and 98.20 levels on the way up.

Additional key levels