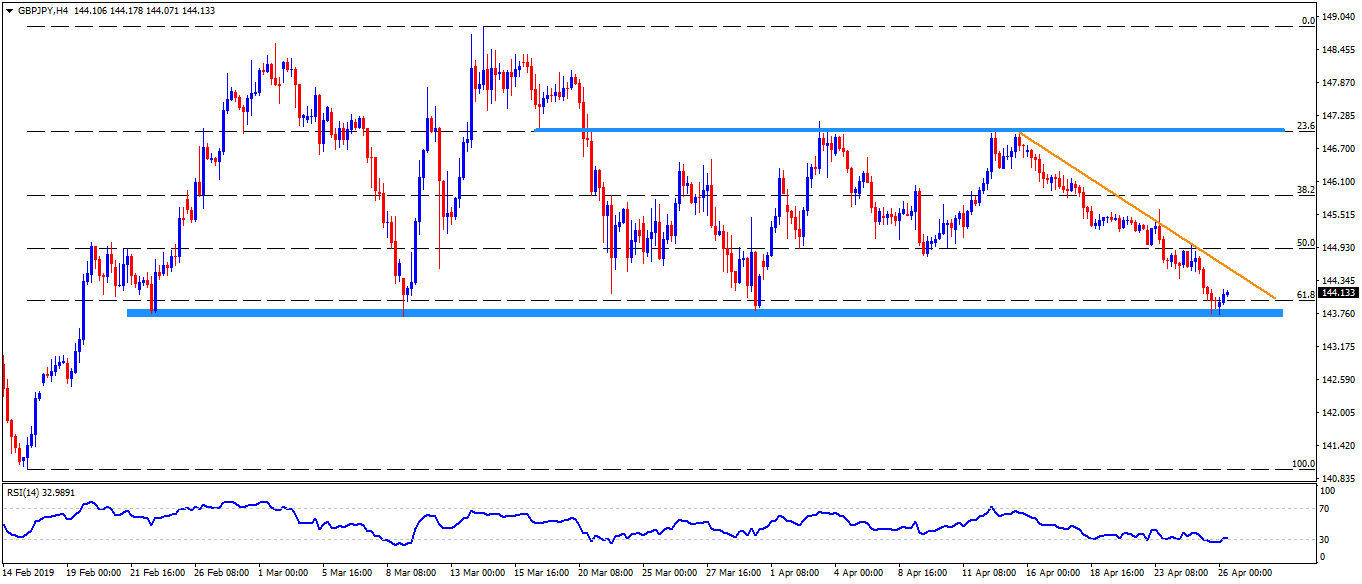

GBP/JPY Technical Analysis: Sellers keep lurking around 143.80/70

- Repeated failures to slip beneath horizontal support and oversold RSI favor the pair’s pullback moves.

- 10-day old trend-line resistance can cap the recovery.

GBP/JPY is on the bids around 144.15 ahead of the UK open on Friday. The pair again bounced off the 143.80/70 support-zone including lows since February 22.

Considering the recent bounce and the oversold conditions of 14-bar relative strength index (RSI), the quote is more likely to revisit 144.25/30 immediate resistance. However, a downward sloping trend-line since mid-April could question the recovery around 144.60.

Given the pair’s ability to cross 144.60, 145.00, 145.50 and 146.30 can entertain buyers while 147.00/05 could challenge them afterward.

On the downside break of 143.70, 143.00 and 142.45 could quickly appear on the chart whereas 142.00 could flash on sellers’ mind then after.

Additionally, 141.50 and 141.00 might prove their worth as supports past-142.00 and prior to 140.00 round-figure.

GBP/JPY 4-Hour chart

Trend: Pullback expected