WTI turns negative below $56.00, trade, supplies eyed

- Prices of the WTI are grinding lower from YTD peaks.

- Renewed trade concerns keep weighing on crude oil.

- API, EIA reports next of relevance in the weekly docket.

The barrel of West Texas Intermediate is trading on the defensive so far today, coming down to the sub-$56.00 area after clinching fresh YTD peaks in the $56.30 area at the beginning of the week.

WTI looks to trade developments, weekly supplies

Prices of the barrel of the American benchmark for the sweet light crude oil are returning to the negative ground for the first time after five consecutive daily advances, including fresh yearly peaks in the $56.30/35 band (February 18).

Trade concerns appear to have re-emerged today following the likelihood of 25% tariffs on US imports of EU cars, as per latest news, all ahead of the start of another round of US-China trade talks in Washington due later today.

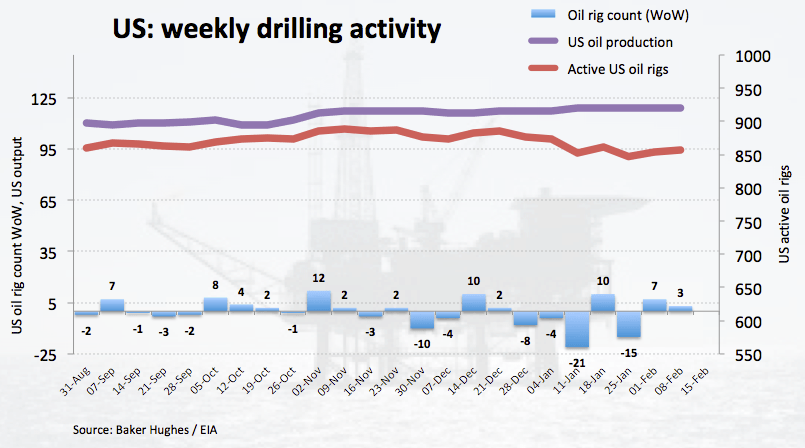

Moving forward, the API and the EIA will report on US crude oil stockpiles on Wednesday and Thursday, respectively, while Baker Hughes will release its US oil-rig count on Friday (+3 prev.).

What to look for around WTI

Hopes of a US-China trade deal have lent extra oxygen to crude oil prices in past sessions and this should remain a key driver in the very near term, although the likeliness of a trade dispute between the US and the EU carries the potential to remove some headwinds from the upbeat sentiment. On the broader picture, the ongoing OPEC+ agreement to curb oil production, US sanctions against Venezuelan and Iranian oil exports and the so-called ‘Saudi Put’ should keep a firm floor under crude prices for the time being.

WTI significant levels

At the moment the barrel of WTI is down 1.12% at $55.36 and a breakdown of $53.99 (10-day SMA) would aim for $53.68 (21-day SMA) and finally $51.15 (low Feb.11). On the flip side, the next up barrier emerges at $56.31 (2019 high Feb.18) seconded by $56.86 (100-day SMA) and then $58.00 (high Nov.16 2018).