Back

16 Nov 2018

US Dollar Index Technical Analysis: Elliot wave pattern sends DXY down with 96.00 as target

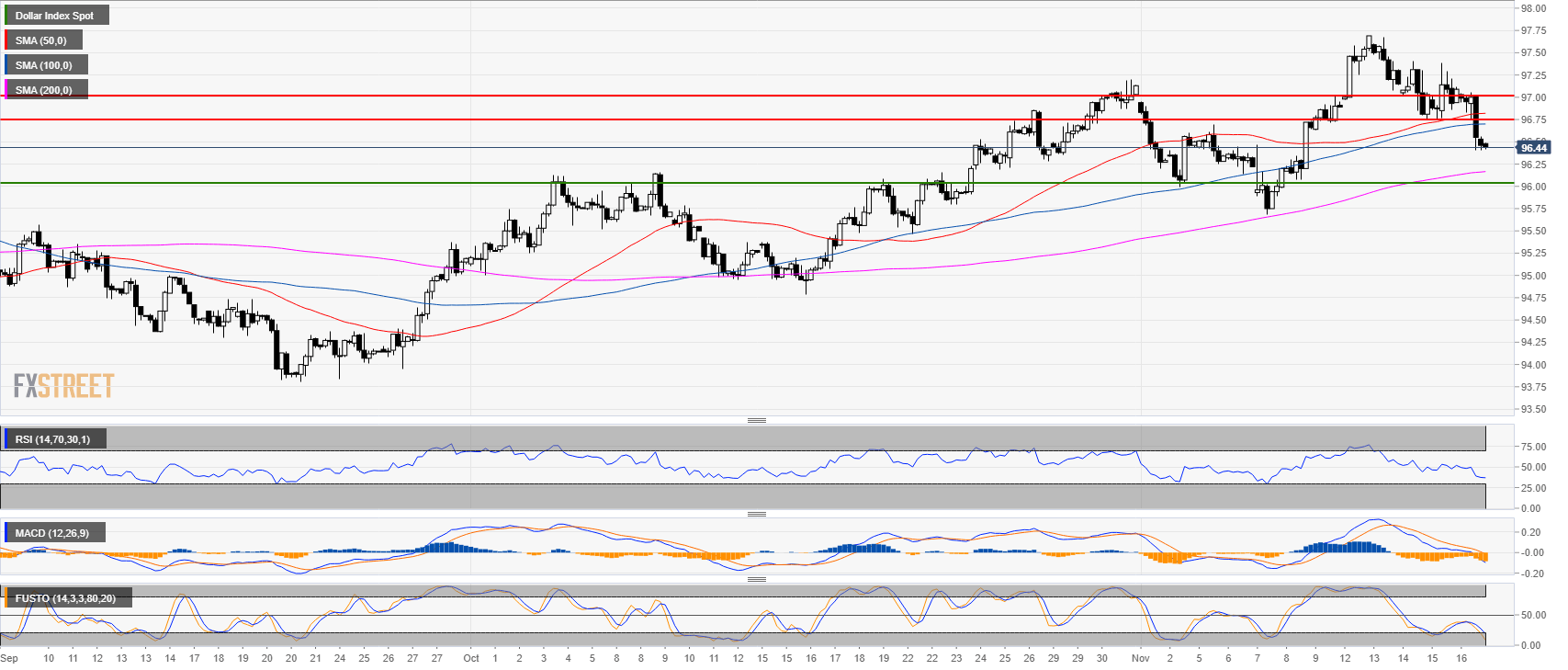

DXY daily chart

- The US Dollar Index (DXY) is pulling back down after the market formed a 5-wave Elliot pattern.

-636779997044583331.png)

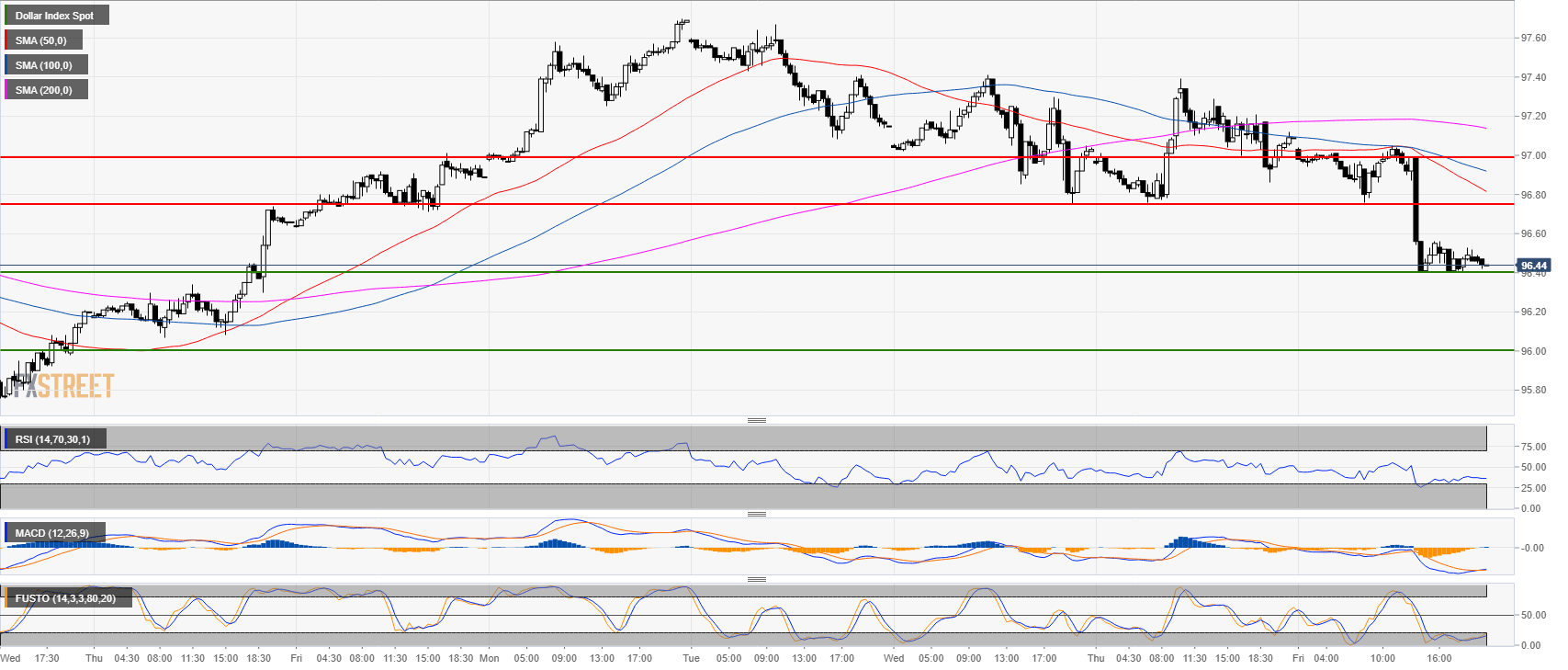

DXY 4-hour chart

- DXY broke below the 50 and 100-period simple moving averages.

- Bears should keep the market below 96.75 and 97.00 figure to keep the bearish momentum going.

DXY 30-minute chart

- A break below 96.40 should open the doors to the 96.00 figure

Additional key levels at a glance:

Dollar Index Spot

Overview:

Last Price: 96.44

Daily change: -65 pips

Daily change: -0.669%

Daily Open: 97.09

Trends:

Daily SMA20: 96.6

Daily SMA50: 95.68

Daily SMA100: 95.36

Daily SMA200: 93.5

Levels:

Daily High: 97.39

Daily Low: 96.76

Weekly High: 97.01

Weekly Low: 95.68

Monthly High: 97.2

Monthly Low: 94.79

Daily Fibonacci 38.2%: 97.15

Daily Fibonacci 61.8%: 97

Daily Pivot Point S1: 96.77

Daily Pivot Point S2: 96.45

Daily Pivot Point S3: 96.14

Daily Pivot Point R1: 97.4

Daily Pivot Point R2: 97.71

Daily Pivot Point R3: 98.03