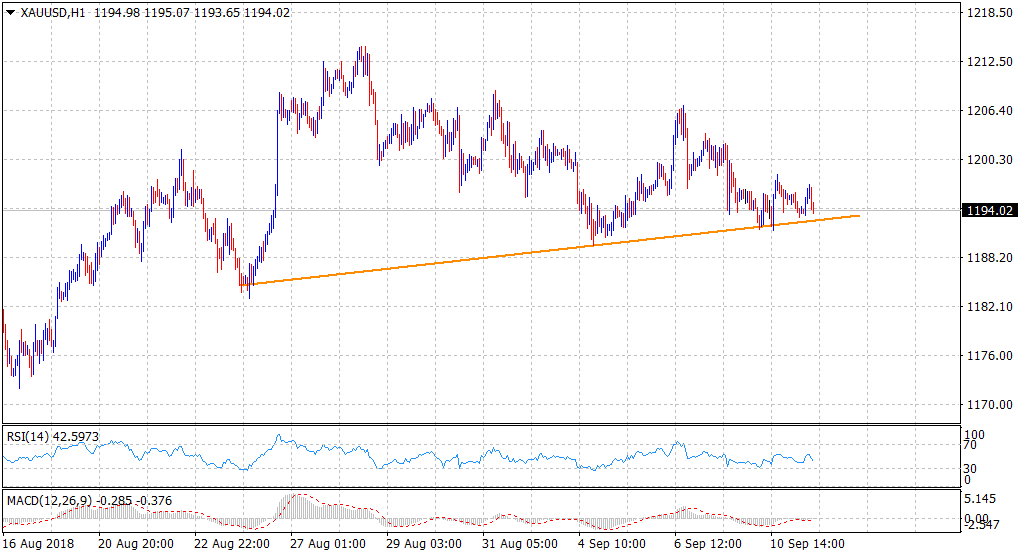

Gold Technical Analysis: Bears await a convincing break through an ascending trend-line support

• The precious metal has managed to defend a short-term ascending trend-line support on the 1-hourly chart, albeit has struggled to gain any meaningful traction.

• The commodity's inability to recover back above the key $1200 psychological mark, despite reviving safe-haven demand, increases prospects for a bearish breakdown.

• Moreover, technical indicators on the mentioned chart have already drifted into negative territory and add credence to the near-term negative outlook.

• However, it would be prudent to wait for a convincing break through the mentioned trend-line support before positioning for any further depreciating move.

Gold 1-hourly chart

Spot Rate: $1194.02

Daily High: $1197.19

Trend: Bearish below trend-line support

Resistance

R1: $1197.19 (current day swing high)

R2: $1200 (round figure mark)

R3: $1204.62 (50-day SMA)

Support

S1: $1291.57 (overnight swing low)

S2: $1287.62 (S2 daily pivot-point)

S3: $1280 (horizontal zone)