USD/CAD Technical Analysis: Struggles to make it through 50-DMA ahead of US CPI, Canadian jobs

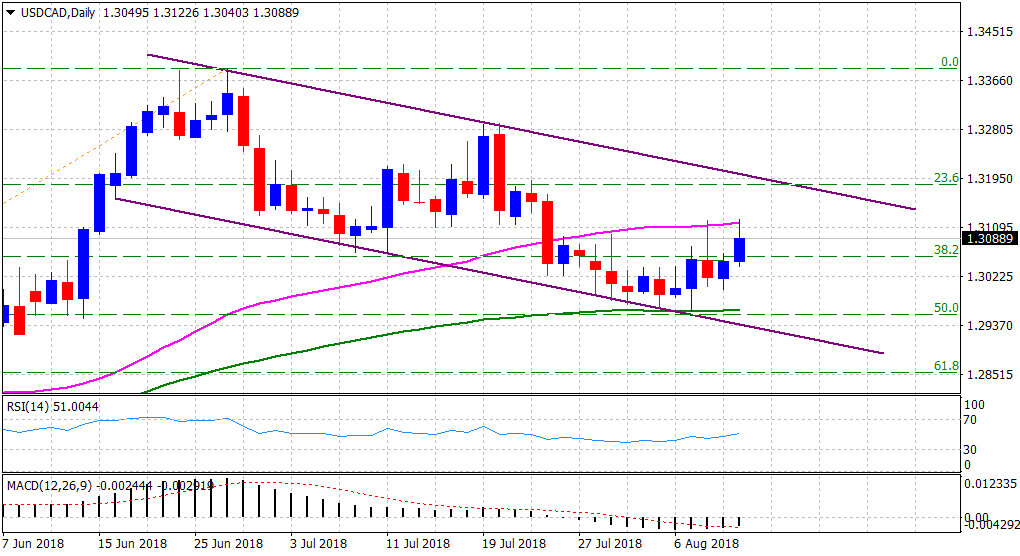

• The 50-day SMA continues to cap the pair's recent bounce from a confluence support, comprising of 100-day SMA and 50% Fibonacci retracement level of the 1.2527-1.3386 upsurge.

• Meanwhile, a descending trend-channel formation on the daily chart suggests near-term bearish bias, albeit will be confirmed only once the mentioned support is decisively broken.

• Alternatively, a convincing move beyond the 50-day SMA barrier might negate the negative outlook and pave the way for the resumption of the prior appreciating move.

• Today's important macro releases - US CPI and Canadian jobs report, might provide the required momentum and assist the pair to finally break out of its two-week-old trading band.

USD/CAD daily chart

Spot Rate: 1.3089

Daily High: 1.3123

Daily Low: 1.3040

Trend: Neutral- near-term breakout awaited

Resistance

R1: 1.3123 (current day swing high)

R2: 1.3147 (R3 daily pivot-point)

R3: 1.3183 (23.6% Fibonacci retracement level)

Support

S1: 1.3040 (current day swing low)

S2: 1.3000 (psychological round figure mark)

S3: 1.2965 (confluence region)