GBP/USD flat around 1.2470 ahead of UK jobs

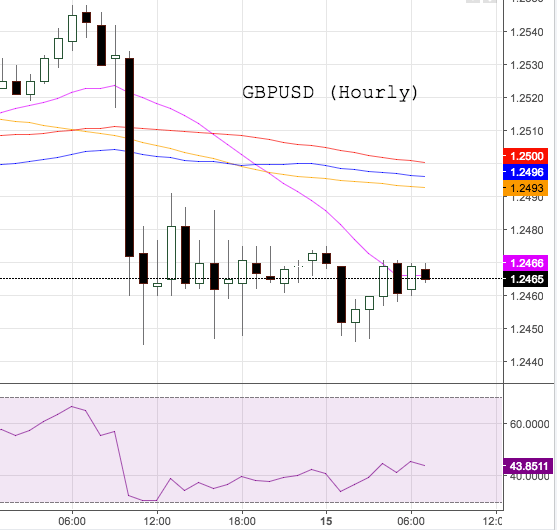

After bottoming out near 1.2440 during overnight trade, GBP/USD has managed to regain the 1.2465/70 band ahead of the European open on Wednesday.

GBP/USD attention to UK data

Disappointing inflation figures on Tuesday plus the hawkish tone from Chairwoman Yellen at her testimony prompted the pair to shed around a cent from tops in the mid-1.2500s to today’s lows in the 1.2445/40 band.

In fact, the greenback was largely benefited on Tuesday after Chief J.Yellen delivered a hawkish message at her Humphrey Hawkins Testimony, once again advocating for gradual rate hikes and adding that it would be ‘unwise’ to wait too long to hike. Yellen’s comments triggered a sell off in the US FI space and fuelled tailwinds for the buck, opening at the same time the door for a rate hike at the March meeting

Later in the session, UK’s labour market figures are due, with consensus seeing the jobless rate at 4.8% in December and the Claimant Count Change increasing by a meagre 1K in January.

Across the pond, the second testimony by Janet Yellen is due along with inflation figures tracked by the CPI, Retail Sales, the NY Empire State manufacturing index, Industrial Production and the NAHB index.

GBP/USD levels to consider

As of writing the pair is losing 0.02% at 1.2466 facing the next support at 1.2436 (low Feb.10) followed by 1.2344 (low Feb.7) and finally 1.2250 (low Jan.19). On the other hand, a breakout of 1.2572 (high Feb.7) would open the door to 1.2680 (high Jan.26) and finally 1.2715 (high Feb.2).