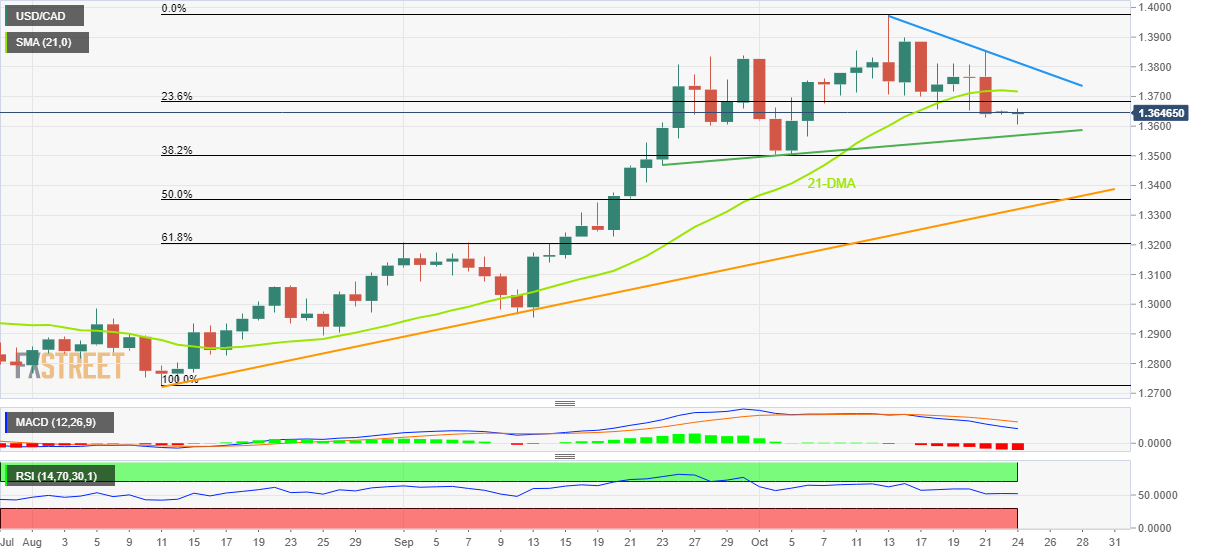

USD/CAD Price Analysis: On the way to monthly support near 1.3570

- USD/CAD remains pressured around fortnight low, keeps Friday’s break of 21-DMA.

- The first daily close below 21-DMA in six weeks, bearish MACD signals favor sellers.

- One-week-old descending trend line adds to the upside filters.

USD/CAD fades the bounce off a two-week low, marked earlier in the day, as it retreats to 1.3645 during Monday’s Asian session. In doing so, the Loonie pair keeps Friday’s downside break of the 21-DMA, the first in over a month.

In addition to the 21-DMA breakdown, the bearish MACD signals and a downward sloping RSI, not oversold, also direct the USD/CAD sellers towards an ascending support line from late September, around 1.3570 by the press time. However, the 1.3600 threshold may act as an immediate rest for the bears.

In a case where the quote breaks the aforementioned support, the monthly low and the 38.2% Fibonacci retracement of the pair’s August-October upside, near 1.3500, will be crucial to watch for the further downside.

Should the USD/CAD bears dominate past 1.3500, an upward-sloping support line from August, close to 1.3320 by the press time.

Alternatively, a daily closing beyond the 21-DMA level of 1.3716 appears necessary for the pair buyer’s return.

Even so, a descending resistance line from October 13 and the previous monthly high, respectively around 1.3815 and 1.3840, will be tough challenges for the USD/CAD bulls.

USD/CAD: Daily chart

Trend: Further downside expected