O que é uma opção de compra longa??

Componentes principais de uma opção de compra longa

Compra longa vs. outras estratégias

Como usar a opção de compra longa

Como aumentar a possibilidade de sucesso

Uma opção de compra longa gera lucro para os investidores após um aumento no preço de um ativo com risco mínimo envolvido. Neste artigo, explicamos os fundamentos básicos de uma compra longa, como operá-la, suas vantagens e desvantagens, e como um investidor pode aumentar sua lucratividade utilizando este instrumento.

Uma opção de compra é um contrato financeiro que, quando executado, dá ao investidor ou detentor o direito, mas não a obrigação, de comprar um ativo a um pré-determinado preço futuro ou preço de exercício dentro de um certo período. Os ativos subjacentes podem ser diversos, incluindo ações, commodities, títulos, moedas, índices e outros. Diferentemente de ações normais, onde o investidor precisa pagar o valor total antecipadamente, uma opção de compra exige apenas um pequeno pagamento inicial. Por exemplo, se você quiser comprar 100 ações de uma ação cotada a $50 por ação, seria necessário pagar $5,000. Em contraste, comprar uma opção de compra requer apenas o pagamento de uma pequena fração do valor do ativo subjacente, conhecido como premium. Por exemplo, se o premium de uma opção de compra sobre essa mesma ação for $2 por ação, você pagaria $200 pelo direito de comprar 100 ações ao preço de exercício. Esse valor inicial vai para o vendedor da opção de compra. Subsequentemente, o vendedor é obrigado a entregar caso o comprador solicite. A estratégia é chamada de opção de compra curta. Além disso, observe que ambas as partes podem optar por encerrar o contrato. Uma opção de compra longa refere-se explicitamente à posição do comprador da opção de compra. Quando os investidores compram uma opção de compra, eles dizem ter uma posição 'longa'. Isso é uma estratégia de alta, pois o comprador lucra se o preço do ativo subjacente subir acima do preço de exercício mais o premium pago pela opção.O que é uma opção de compra longa?

Os componentes principais de uma compra longa são: Conceitos adicionais essenciais relacionados a uma opção de compra longa incluem:Componentes principais de uma opção de compra longa

Alavancagem. Uma vantagem das opções de compra é que elas permitem aos investidores controlar grandes valores de contrato com apenas um pequeno capital inicial, tornando-as lucrativas, pois podem gerar grandes lucros usando alavancagem. Risco limitado. A opção de compra possui uma relação de risco para recompensa definida, que ajuda os compradores a controlar a possibilidade de perda. Flexibilidade. No trading de opções, os investidores têm a opção de selecionar diversos preços de vencimento para o contrato. Assim, um investidor pode adaptar sua estratégia para atender à perspectiva do mercado a qualquer momento. Potencial de lucro. Se um investidor tomar uma decisão correta, ele pode obter lucros significativos, especialmente em casos de alta volatilidade onde o ativo subjacente aprecia substancialmente.Vantagens

Em alguns casos, o contrato pode resultar em perda total do valor inicial do premium pago. Comparado a outros ativos, como moedas, a opção não gera um lucro de um para um com o subjacente. Em alguns casos, o ativo subjacente pode apenas render $0.7 por um movimento de $1 devido ao delta. Delta é um valor chave no trading de opções. Ele indica o quanto o preço de uma opção muda quando o ativo subjacente, como uma ação, varia em $1. Mostra quão sensível a opção é às mudanças de preço. Por exemplo, se uma opção de compra tem um delta de 0.2 e a ação sobe $1, o preço da opção deve subir cerca de $0.20. Delta varia ao longo do tempo. No início da vida da opção, ou quando a opção está longe de gerar lucro, o delta tende a ser baixo porque a chance de a opção se tornar lucrativa é menor.Desvantagens

Aqui, explicaremos as diferenças entre a opção de compra e outras estratégias de trading. Opção de compra longa vs. compra de ações. Os investidores precisam de menos capital para iniciar um contrato de compra longa do que para comprar ações ou participações. Isso reduz o risco envolvido em casos onde o contrato não é lucrativo. Além disso, um investidor no mercado de ações ou investindo em ações não está sujeito a limites de tempo, como no caso do trading de opções. Opção de compra longa vs. opção de compra curta. Uma opção de compra curta é o oposto de uma opção de compra longa. Nessa estratégia, o vendedor da opção longa recebe um premium em troca da obrigação de vender o ativo subjacente ao preço de exercício, caso o comprador opte por exercer a opção. Essa é uma estratégia de baixa ou neutra, dependendo do contexto, pois o vendedor lucra quando o preço do ativo subjacente permanece abaixo do preço de exercício. No entanto, o risco é potencialmente ilimitado se o preço do ativo subir significativamente, já que o vendedor pode ter que comprar o ativo a um preço de mercado mais alto para vendê-lo ao preço de exercício mais baixo.Compra longa vs. outras estratégias

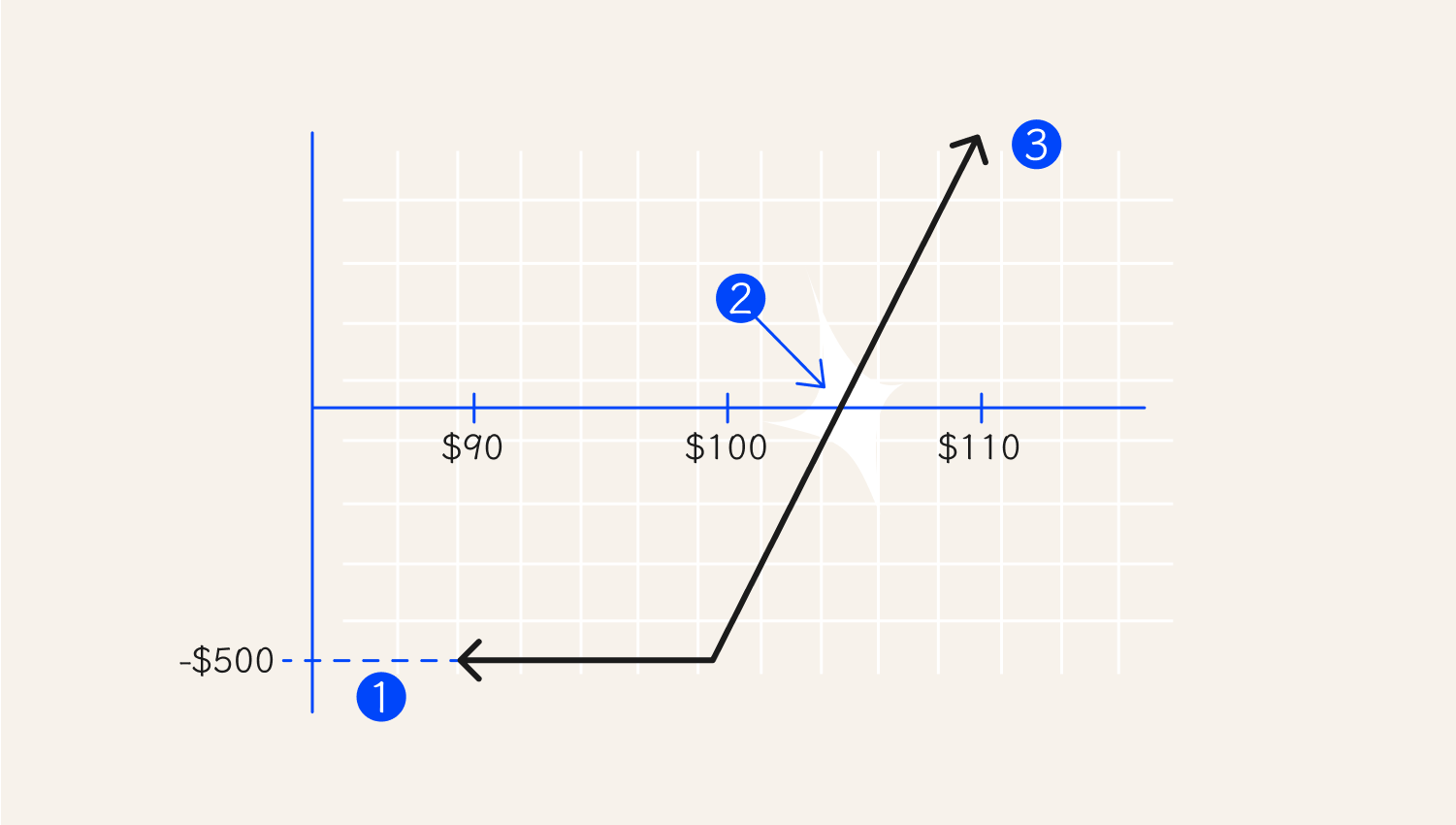

O diagrama abaixo explica a opção de compra longa. Primeiramente, os investidores devem observar que o risco máximo é limitado ao custo da opção. Assim, o ganho potencial e a possibilidade de lucro são ilimitados. Em segundo lugar, para um investidor ganhar dinheiro, o preço da ação subjacente deve ser superior ao preço de exercício no ponto de vencimento. No exemplo abaixo, uma opção de compra longa com preço de exercício de $100 comprada por $5 tem uma perda potencial de $500 e ganho ilimitado somente se o preço continuar a subir. É essencial entender que o preço subjacente deve ser maior que $105 no vencimento para que o investidor ganhe dinheiro.Exemplos

1. Perda máxima

2. Ponto de equilíbrio: $105

3. Lucro máximo é ilimitado

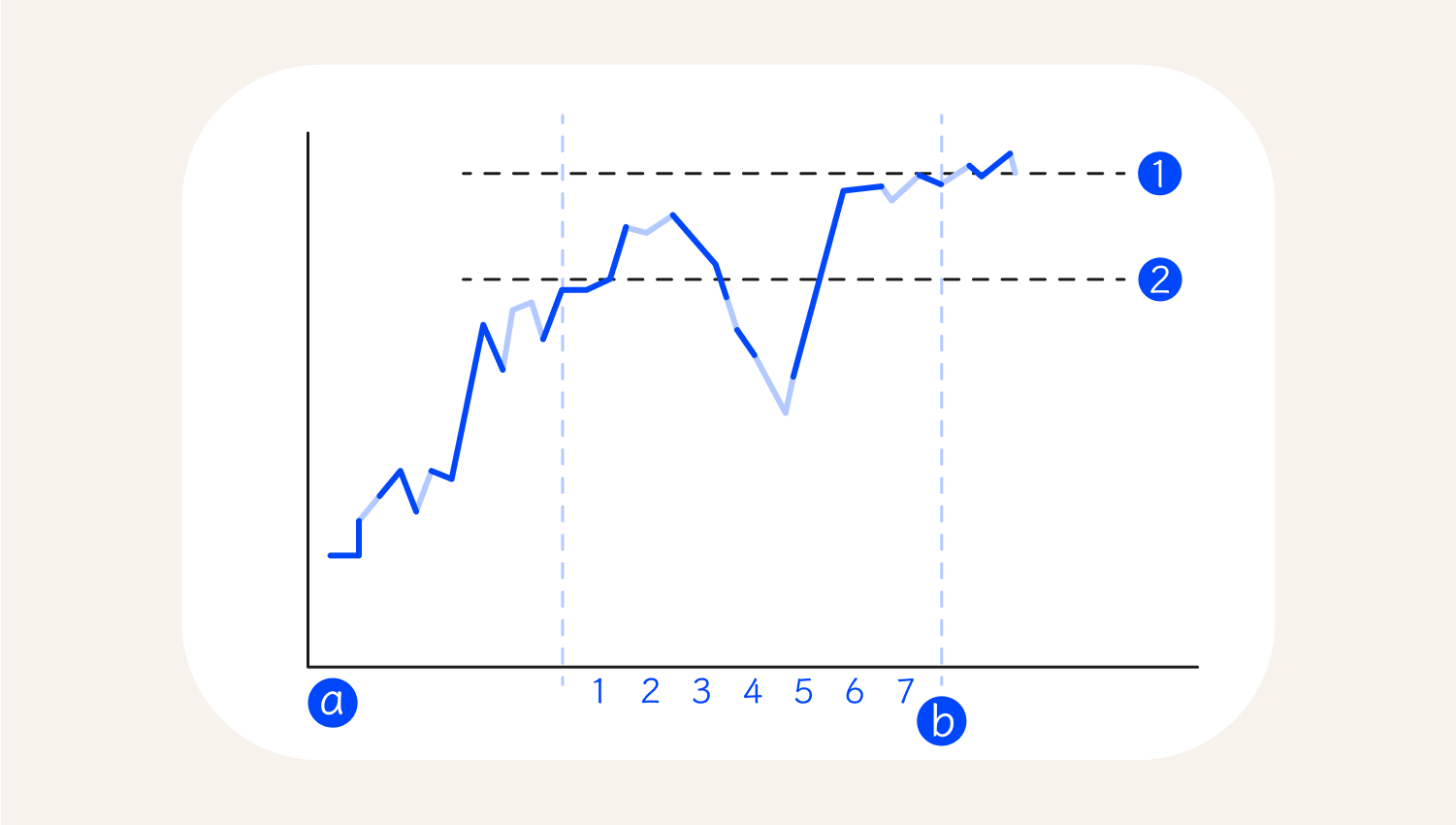

Usar uma opção de compra longa envolve comprar uma opção de compra quando você espera que o preço do ativo subjacente suba. Veja como usar esta estratégia de forma eficaz:Como usar a opção de compra longa

1. Lucro

2. Preço de exercício

a. Dias

b. Data de vencimento da opção

Começar com pouco. Se você é novo no trading de opções, é inteligente começar com pouco, pois isso lhe dará tempo para entender o mercado e ganhar experiência. Além disso, lembre-se sempre de que trading é arriscado — não invista mais do que está preparado para perder. Usar análise técnica. Há décadas todos os investidores utilizam indicadores técnicos para identificar áreas potenciais de entrada e saída. Além disso, na análise técnica, você pode acrescentar padrões de gráfico, como harmônicos e padrões de candle, para melhorar sua estratégia. Manter-se informado. Bons investidores estão constantemente atualizados sobre os fundamentos que impactam o mercado. Portanto, selecione blogs ou canais que o manterão informado com notícias como relatórios de ganhos, índices de preços ao consumidor e outros fatores essenciais que impactam significativamente seus ativos escolhidos. Diversifique seu portfólio. Não coloque todo o seu capital em um único ativo. Criar um portfólio ajudará você a ter sucesso, já que as posições não lucrativas serão compensadas por outras.Como aumentar a possibilidade de sucesso

Considerações finais